Introduction

Saving money can be hard, especially when you have a tight budget. A biweekly savings plan helps you save a little money every two weeks instead of trying to save a large amount once a month. This approach fits well with how many people receive their paychecks and can make saving easier and less stressful.

In this article, you will learn how a biweekly savings plan can help low income households build their savings. You will find practical tips on starting your plan, ways to stay consistent, and ideas to make saving a part of your daily life. Let’s explore how this method can work for you.

Understanding Your Income and Expenses

When you’re working with a tight budget, knowing exactly where your money comes from and where it goes is crucial. It might seem obvious, but many people don’t have a clear picture of their income and expenses—and that can make saving a real challenge.

Start by listing all sources of income, no matter how small or irregular. This might be your paycheck, government benefits, side earnings, or even occasional gigs. Try to track when you get paid—whether it’s weekly, biweekly, or monthly—and how much you usually receive. Pay attention to changes like overtime or reduced hours, since these affect how much you can save.

Next, focus on your expenses. This means writing down everything you spend on, every single dollar, from rent to that cup of coffee. Tracking expenses can feel tedious, but it reveals where your money slips away. Use a notebook, an app, or even a simple spreadsheet—whatever feels easiest for you.

By doing this, you can spot areas that might be cut back or adjusted. Maybe you’re surprised by how much goes to small, recurring charges like subscriptions or daily snacks. Knowing your payment schedule and your spending patterns helps shape a savings plan that actually fits your life.

Benefits of Biweekly Savings for Low Income Households

Saving money when your income is tight can feel like a big ask, but choosing to save every two weeks can actually make it more doable. Many low income households get paid on a biweekly basis, which means the timing matches naturally with when money comes in. This makes it easier to put aside smaller amounts more regularly, instead of trying to scrape together a larger sum once a month. It’s less overwhelming that way, right? Instead of thinking, “Where will I find $100 at the end of the month?” breaking it down into, say, $50 every two weeks feels a bit more approachable.

This kind of schedule can help your budget, too. Expenses often pop up throughout the month—bills, groceries, emergencies—so saving smaller chunks more often can avoid clashes with big payments. You might find it a bit easier to adjust your spending as you go rather than waiting for one big “save day.”

Another thing I’ve noticed is how saving every two weeks actually helps build the habit itself. When you do it frequently, it becomes part of your routine. It’s like brushing your teeth—after a while, you just do it without thinking much. This repetition encourages discipline. Even if the amount saved seems small, over time it adds up, and the routine makes you less likely to skip saving altogether.

Imagine setting an alert or making it automatic so you don’t have to remind yourself constantly. That steady rhythm makes saving feel less like a chore and more like a natural part of managing your money. It’s not perfect though. Sometimes life gets in the way, and skipping a deposit might happen, but getting back on track usually feels easier when your savings habit is frequent.

These small wins build confidence. You may start doubting if you can save at all, but with biweekly savings, the pace encourages progress you can see and feel. So, perhaps this steady, smaller approach isn’t just about the money, but also about how saving fits into the everyday realities of living on a limited income. It’s subtle, but it makes a difference.

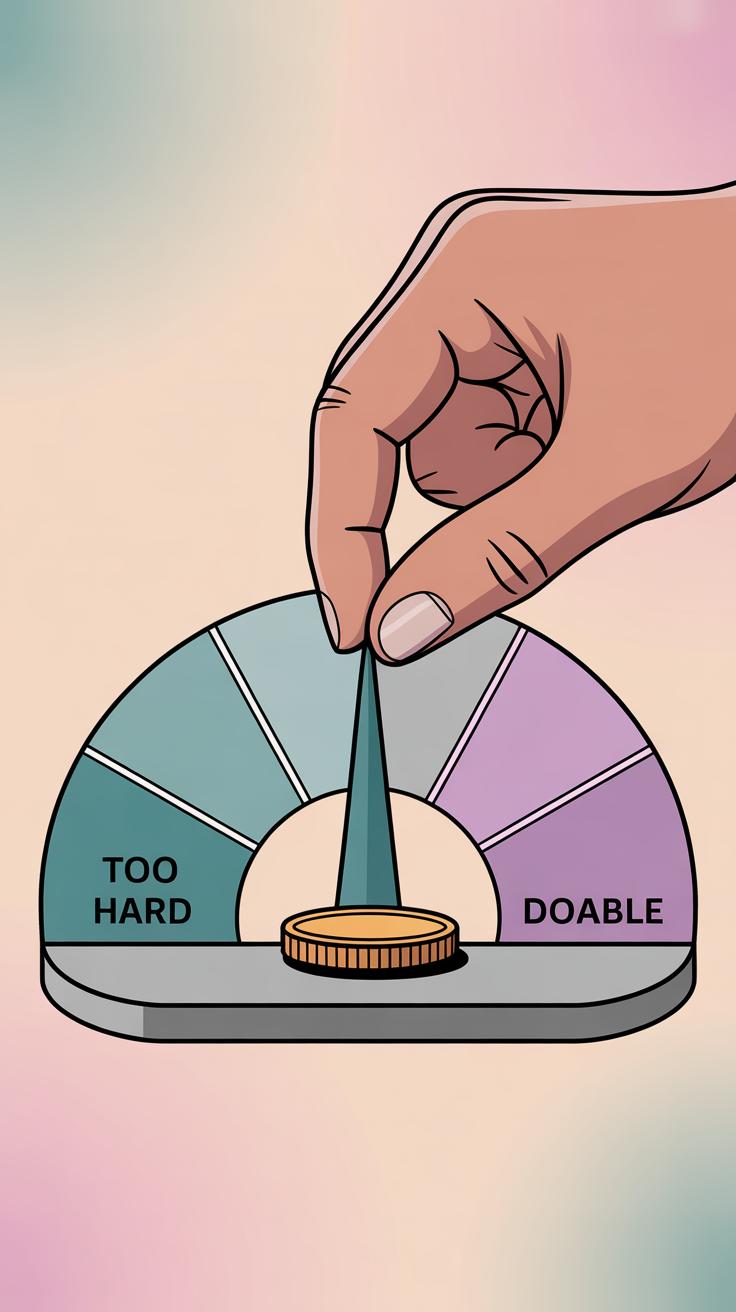

Setting Realistic and Achievable Savings Goals

When you’re working with limited income, setting savings goals might feel like aiming for something out of reach. But the trick is to keep those goals clear and realistic. Instead of thinking about big, distant targets, try breaking them down into smaller, specific amounts that fit comfortably within your budget. Like deciding to save $10 every two weeks rather than $100 once a month—it’s easier to stay on track and less frustrating.

Starting small actually builds confidence. You won’t feel overwhelmed by an impossible number. Even if it’s just a few dollars at first, it still adds up over time. And maybe you’ll surprise yourself by how natural saving can become when the goal feels manageable.

Don’t lock yourself into one number forever. Life changes—your income might go up or down, or unexpected expenses could appear. That means your goals can and should shift with those changes. Reviewing your savings targets every few months helps keep things in balance and realistic. You may find that what once felt doable now seems too tight, or perhaps you’re ready to challenge yourself a bit more.

Have you thought about what a reasonable starting point looks like for you? What small amount feels achievable without stretching too far? And could you see adjusting that amount later, when your situation changes? These questions matter because setting goals isn’t a one-time deal—it’s an ongoing process that adapts to your life.

Creating a Biweekly Savings Schedule

Setting up a savings schedule every two weeks might sound straightforward, but sticking to it can be tricky, especially when money feels tight. One key is to plan your savings right after you get paid. That moment—payday—is when your budget is freshest. If you wait, it’s easy to lose track or convince yourself to spend instead. So, setting aside a specific amount right away can prevent those “I’ll save later” thoughts from sneaking in.

Think about it like this: imagine you get paid on the 1st and 15th of each month—you decide immediately that a fixed sum moves into your savings. Even if it’s a small figure, the habit of saving on payday creates a rhythm.

To keep the schedule visible, using a calendar or a mobile app helps a lot. Mark your two weekly paydays and note the savings goal beside each date. You could use a simple paper calendar, a reminder app, or budgeting tools like EveryDollar or Goodbudget. These apps send nudges that help you remember and track what you’ve saved. Seeing progress, even if small, builds motivation.

Would you say you’re more likely to save if you see your achievements daily? I think so. Watching your savings grow—step by step—makes the process less abstract. It feels like you’re in control, not just waiting for some future day when saving becomes possible. And that’s the trick: turning saving into something you do, not wish for.

Smart Saving Methods for Low Income Families

Saving money, especially when every dollar counts, can feel like a puzzle. But it doesn’t always mean working harder; sometimes, it means saving smarter. One method many find surprisingly helpful is setting up automatic transfers from your checking to your savings account. It’s like tricking your brain into saving without thinking much about it—your money moves quietly, and you get used to not seeing that portion as spendable.

If possible, try to schedule this transfer right after you receive your paycheck. It might seem small, but even $10 every two weeks adds up over time. You won’t have to remind yourself or rely on willpower, which is often the hardest part of saving.

Cutting back on unnecessary spending can be tricky, though. What counts as unnecessary? Here are some spots where savings often hide:

- That daily coffee shop visit—making coffee at home could save several dollars weekly.

- Subscription services you hardly use or forgot to cancel. Sometimes, it’s those $5 a month deals that sneak up on you.

- Impulse buys, like small snacks or items picked up just because they’re “on sale.”

- Energy costs—turning off lights when not needed or unplugging devices can trim your bills.

Sometimes, cutting expenses feels uncomfortable or like a sacrifice, and you might slip up. That’s okay; the goal isn’t perfection, just progress. You might wonder if skipping the coffee actually matters, but those little choices shape your ability to save steadily over weeks. What small expense do you think you could let go of without much pain?

Handling Unexpected Expenses Without Breaking Your Plan

Build an Emergency Fund Slowly

Saving money when you’re on a tight budget can feel impossible, especially when unexpected expenses pop up. Still, setting aside even a small emergency fund can make a real difference. You don’t have to save hundreds right away. Start with a goal as low as $100, or even $50, whatever fits your situation.

Try to tuck away a bit of money every two weeks along with your biweekly savings plan. It might be as little as $5 or $10, but those amounts add up. Over time, you’ll have something to lean on, which can prevent the need to borrow money or skip essential expenses when emergencies happen.

It may seem slow, maybe frustrating, but growing your emergency fund bit by bit gives you a cushion. You won’t have to stop your entire savings plan when life throws you a curveball.

Prioritize Essential Spending

When money gets tight after an unexpected bill, figuring out what to pay first can feel overwhelming. Here’s a simple way to think about it:

- Start with essentials that keep a roof over your head — rent or mortgage, utilities, and food.

- Next, cover basics like transportation and any necessary medications.

- Once those are sorted, look at other bills or minimum payments.

This order isn’t perfect for everyone, but it helps to focus on what keeps you stable. Sometimes, it means you might delay less urgent payments or ask about payment plans. Don’t hesitate to communicate with creditors; many offer flexibility if you explain your situation.

It’s tricky balancing emergencies with saving, but by prioritizing essentials and growing your emergency fund over time, you can stay on track without feeling you’re constantly putting out fires.

Using Community Resources and Support

When you’re trying to save on a tight budget, tackling it all alone can feel a bit overwhelming. But, maybe you don’t have to. There’s a surprising number of local and online resources aimed specifically at helping families with lower incomes manage money better and stretch every dollar.

One of the most practical steps is finding free financial advice. Plenty of community centers, nonprofit organizations, and even some libraries offer free workshops or one-on-one counseling focused on budgeting, debt reduction, and smart saving habits. Places like local credit unions or community action agencies often provide these sessions. You might be surprised how much a little guidance can clear up confusion or even shift your mindset about money.

Also, government assistance programs can lighten the load more than you expect. Programs like SNAP for food, utility assistance, or housing subsidies aren’t about handouts but about freeing up cash that you can then tuck into your biweekly savings. Sometimes, it’s worth checking your eligibility every year because these programs change and your situation might qualify you for new benefits.

Look around for local charities or faith-based groups too. Some offer emergency help, while others provide ongoing aid—think low-cost childcare or discounted health services. These supports can make a real difference, allowing you to redirect those funds into your savings plan instead. Do you know your community options well? If not, maybe it’s time to explore or ask around—sometimes people just don’t realize what’s available.

Tracking Your Savings and Celebrating Progress

Keeping track of your savings growth might feel like a small task, but it plays a surprisingly big role in staying motivated. When you jot down each deposit, you make your progress real. It’s not just a vague idea in your head; it becomes something tangible. You could use a simple notebook or even a basic spreadsheet on your phone—whatever feels easiest. The key is consistency. Writing down the amount you put aside every two weeks, and noting the total over time, lets you see the pile growing, slowly but surely.

It’s okay if some entries aren’t perfect or you miss a few days. What matters is coming back to it and keeping the habit alive. Seeing those numbers climb—even if the steps are small—can give a real boost.

Keep a Simple Savings Journal

Think of a savings journal as your personal record. Every two weeks, write down:

- How much you saved

- Your cumulative total

- Any surprises or setbacks

This habit can help spot patterns too. Maybe some pay periods you save more, other times less, and that’s okay. Tracking helps you understand your rhythms, which can guide adjustments later on.

Reward Yourself for Achievements

Recognizing your progress doesn’t have to mean spending extra. Celebrate small wins with little things that lift your mood. Maybe a favorite cup of coffee at home, a movie night in, or a short walk in a nearby park. These small, low-cost rewards create positive reminders that saving is worthwhile.

Ask yourself: what feels like a treat to you but won’t break the budget? Finding ways to enjoy the journey keeps motivation steady. Remember, saving money is as much about building good habits as it is about money itself.

Adjusting Your Plan As Life Changes

Life rarely stays the same for long, especially when money is tight. Your biweekly savings plan might work well today, but what happens if your income drops or new bills pop up? Recognizing when it’s time to tweak your plan can keep your savings on track without causing more stress.

Look out for clear changes like losing a job, switching to part-time, or unexpected expenses such as medical bills or car repairs. These shifts might mean your original savings target feels out of reach—or even unrealistic for a while. That doesn’t mean you need to stop saving altogether.

Try adjusting the amount you save every two weeks instead of stopping. For example:

- Cut your savings contribution in half temporarily.

- Space out your savings to every month instead of every two weeks.

- Find smaller pockets in your budget to save even just a few dollars.

It’s okay if the plan looks different now than before. Staying consistent with some savings, even if less, keeps the habit alive. When things get better, you can rebuild the amount gradually.

Changing your plan doesn’t mean failure. Sometimes, it’s just about being smart and gentle with yourself while still holding on to the goal. You’ll find yourself better prepared when life shifts again—because you didn’t give up entirely, you adapted. Isn’t that a kind of win?

Long Term Benefits of Consistent Biweekly Savings

Sticking to a biweekly savings plan, especially when money is tight, can feel slow at first. But over time, those small deposits add up in surprising ways. It’s not just about the numbers growing; it’s about what they represent—a steady habit that builds resilience.

Saving consistently every two weeks helps create a deeper sense of financial security. When unexpected expenses hit, like a car repair or medical bill, having money set aside can ease the pressure. You might not completely avoid stress, but being somewhat prepared can change how you face those moments.

Money saved over the years also opens doors that might have seemed out of reach before. It can pay for job training, buy tools for a side business, or cover education costs that improve your earning potential. Sometimes, it’s just the buffer you need to take a small investment risk or handle an emergency without falling behind.

- You start to feel less overwhelmed by financial uncertainty.

- Regular savings create options that didn’t exist earlier.

- Patience with the process teaches discipline that can spill into other areas of life.

Have you thought about how much your savings could grow in 5 or 10 years? Even modest, regular amounts change the picture. The long haul matters more than the short bursts.

Conclusions

A biweekly savings plan breaks down saving into smaller, manageable amounts aligned with your income schedule. This helps make saving consistent and easier to stick to. Over time, even small savings add up and can provide a safety net for emergencies or future needs.

Start by setting clear goals and choosing an amount you can comfortably save every two weeks. Use the steps and tips from the chapters to keep on track and adjust your plan as needed. Saving regularly helps you take control of your finances and build a better future.