Introduction

A Spending Tracker is a tool that helps you keep an eye on where your money goes. It can be very useful especially when you want to try a No Spend Month. A No Spend Month means not buying anything except the things you really need. This helps you save money and see your spending habits clearly.

In this article, you will learn how a Spending Tracker can make a No Spend Month simpler. We will talk about different ways to track your expenses, how to plan a month without spending, and how to stay on track. This will show you how to manage your money smartly and reach your savings goals.

What is a Spending Tracker

What is a Spending Tracker

A spending tracker is simply a tool you use to keep an eye on where your money goes. Think of it as a diary, but for your expenses instead of your daily thoughts. Many people use it because it makes spending less mysterious—you know exactly what you bought and how much it cost. This clarity often helps avoid those moments when you wonder, “Where did all my money disappear to?”

By tracking your spending, you start seeing patterns. Maybe you realize you spend more on coffee than you thought, or that small purchases add up surprisingly fast. The point isn’t just to monitor but to get better control over your money. It nudges you toward smarter choices without needing to guess or cut everything out suddenly.

Types of Spending Trackers

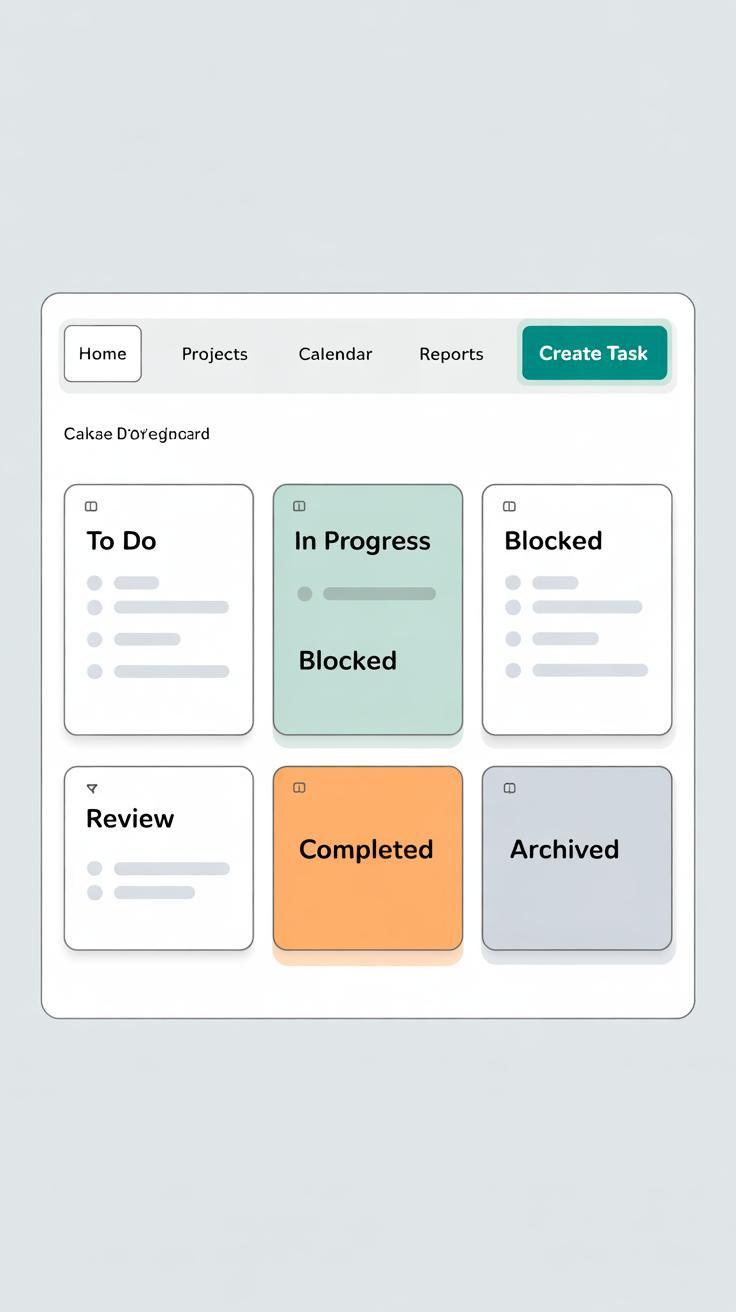

Spending trackers come in all shapes and sizes. Some prefer apps on their phone—these can automatically link to your bank accounts, making tracking quick and almost effortless. Others find spreadsheets helpful because they provide customization, letting you organize expenses by categories or dates exactly how you want.

Then there’s the traditional pen and paper method, which might feel slower but sometimes helps with remembering what you spent by physically writing it down. Each type works differently depending on what feels natural to you and how much time you want to spend managing your expenses. Maybe apps suit those who want automation, while paper fits those who prefer a tactile approach.

How Spending Trackers Help with Budgeting

Trying to stick to a budget without knowing what you spend feels like navigating in the dark. A spending tracker sheds light on your habits, so creating a budget becomes less guesswork. When you see what you actually spend on groceries, dining out, or entertainment, you can set more realistic limits on each category.

Tracking expenses regularly also helps you stick to your budget—it’s harder to overshoot when you’re aware of every purchase. You might want to ask yourself: Are these spending habits improving or slipping away? The tracker serves as a reality check, making it easier to adjust your budget before things go off course.

What is a No Spend Month

A No Spend Month means setting a period—usually 30 days—where you purposely avoid unnecessary spending. You still pay the essentials, like rent and bills, but you steer clear of extras that usually sneak into your daily routine. The idea is to break habits that lead to impulse buys or just casual spending. It’s not about deprivation, really, but about tuning into your actual needs versus wants.

People try this to reset their financial habits, get a clearer picture of where their money goes, and, of course, to save cash faster. Sometimes, it’s the surprise of how much small purchases add up that motivates the challenge. Beyond just saving money, a No Spend Month often shifts your mindset—you might start questioning purchases more, realizing that a lot of things you thought were necessary aren’t really that urgent.

Rules of a No Spend Month

Rules can vary, but the goal remains the same: limit spending on non-essentials. Common guidelines include:

- Pay only for necessary expenses — think rent, utilities, groceries, prescriptions.

- Avoid dining out, coffee runs, online shopping, new clothes, and entertainment subscriptions.

- Use what you already have—consuming from stockpiles, leftovers, and existing belongings.

- Delay purchases—if you find something tempting, wait 24 to 48 hours before deciding.

- Track every expense carefully. Even a small snack might break your streak.

These rules might sound strict, and they can be. Still, some people adjust them based on their lifestyle. For example, commuting costs might be unavoidable, or you might decide it’s okay to spend a bit on a hobby if it keeps you sane. Flexibility helps, but it also risks weakening the purpose.

Common Challenges in No Spend Months

Going no spend isn’t exactly easy. A few hurdles tend to come up:

- Temptation: Sales, social outings, advertisements—they all whisper “just this once.” It’s a real test of willpower.

- Social pressure: When friends invite you out, it’s awkward saying no, especially if food or drinks are involved.

- Unexpected expenses: Emergencies happen. Places like the mechanic or doctor don’t care about your budget goals.

- Boredom: Sometimes buying something feels like an activity. You might try to fill downtime with retail therapy without realizing it.

Overcoming these challenges often means planning ahead. You might cook more at home, explain your goals to friends, set aside an emergency fund before starting, or find low-cost or free activities to replace spending-driven habits. And, well, patience. It’s not always fun, but it can pay off—literally.

Setting Up Your Spending Tracker

Picking the Right Tool for You

Choosing a spending tracker might feel like a small step, but it can make or break your No Spend Month. Think about how you like to track—do you prefer something simple and manual, like a notebook or spreadsheet? Or would a digital app suit you better, with automatic syncing and notifications? Sometimes, people get excited about flashy apps but then abandon them because they’re too complicated. So, it’s okay to start basic and upgrade later.

Consider your daily habits. If you’re always on your phone, an app that sends quick reminders might keep you accountable. But if you like reflecting at night, logging expenses in a journal can work well. Also, some apps link directly to your bank accounts, tracking expenses automatically—handy but maybe a little less mindful. Think about what fits your lifestyle and won’t feel like a chore.

Organizing Your Spending Categories

When setting up your categories, aim for balance. You want enough detail to see where your money goes, but too many categories can make tracking a headache. Start broad—food, transportation, bills, entertainment—and add subcategories only if they help you understand spending better. For example, splitting “food” into groceries and dining out can highlight areas to cut during the month.

Don’t obsess over perfection here. Categories can evolve as you learn your habits. I once made a category called “miscellaneous” just to avoid overcomplicating things—and it worked fine for me. What’s important is that each expense fits somewhere, so you don’t lose track or skip entries because you’re unsure where they belong. Keep it simple, clear, and adjustable.

Recording Your Daily Expenses

Keeping track of your spending every day is really the backbone of a successful No Spend Month. When you note expenses as they happen, or shortly after, you avoid missing small purchases that quietly add up. It’s tempting to think you’ll remember everything at the end of the day, but that rarely works out. Small coffees, impulse buys, even minor fees—if skipped—can sneakily undermine your goals.

Accuracy makes a real difference, so jot down amounts carefully, check receipts if you can, and don’t guess or round too much. This helps you see the real picture rather than a fuzzy one. There’s a certain clarity that comes with precise tracking. And that clarity can stop lapses before they grow.

Making Tracking a Daily Habit

Remembering to track every day feels like a hassle at first. A simple way is to pick a fixed time—like right after lunch or before bed—when you pause for just a few minutes to enter your expenses. Setting a reminder on your phone can nudge you, though sometimes those get ignored too. What often works better is pairing tracking with a daily routine you already have, like brushing your teeth or winding down with a book.

Motivation can dip, especially during stressful days. I found that reminding myself why I’m doing this—saving money and building discipline—can spark enough motivation. Plus, seeing even small progress on your tracker feels encouraging. You might be surprised by how a little daily check-in can keep you accountable even when you don’t feel like it.

What to Record and How

It’s not about logging every detail but striking a balance. At the very least, note:

- What you bought or the service paid for

- The exact amount spent

- The date and sometimes the place or category (like groceries, transport)

Some people prefer more detail, like payment method or notes on why the purchase was necessary, but that’s optional unless you find it useful. Avoiding vague entries like “stuff” or “misc” can help, since they defeat the purpose of hindsight analysis.

Using a simple spreadsheet, a notebook, or an app can make recording easy—and after a few days, it doesn’t feel like a chore. What matters is consistency more than perfection. Once you’re in the habit, the habit does the work for you.

Analyzing Your Spending Data

Once you’ve logged your expenses for a while, the real work begins—sifting through the numbers to see what’s actually happening with your money. This step might feel a bit tedious, but it’s where a spending tracker really earns its keep. Take some time—don’t rush—to review your entries carefully. Look for any expenses that repeat weekly or monthly. For example, maybe you have a subscription you forgot about or a daily coffee run that adds up more than you realized.

Watch for habits, too. Do you notice spikes around payday or specific days when spending jumps? Those patterns can tell you where impulse or convenience takes over. Once identified, you can question if those expenses are necessary or just automatic.

Next, try to spot pockets where cutting back is possible. Sometimes it’s the obvious stuff like dining out or shopping, but other times, small regular charges—like extra snacks or occasional rideshares—stack up. You might find it easier to say no to bigger purchases once you’ve trimmed those “hidden” expenses.

When you see these patterns, ask yourself: which ones can I realistically reduce or pause this month? Does canceling a subscription matter more than skipping takeout? Or maybe brewing coffee at home is simpler than cutting out all treats. The point is, the data shows where your spending is automatic or habitual. Noticing that gives you the upper hand during a No Spend Month.

Planning Your No Spend Month

Setting Clear Goals

Start by figuring out what you really want to achieve with your No Spend Month. Is it saving a specific amount? Building better shopping habits? Or maybe just proving to yourself that you can? Your spending tracker should give you clues here. Look at your past habits and decide what feels realistic but still challenging.

Try writing down concrete goals. For example: “I want to reduce dining out costs by 80%,” or “I aim to save $200 by not buying non-essential items.” Clear goals help keep you honest when temptation hits. But be ready to tweak them if something feels too rigid—flexibility can keep motivation alive.

Preparing for Necessary Expenses

Not all spending can stop, and your tracker can help spot those unavoidable costs—rent, bills, medications, and so forth. Before your No Spend Month, list these essential payments. Some might surprise you; for instance, that annual subscription you forgot about or a planned car maintenance. Mark them down.

Then, plan how to cover these without breaking your No Spend rules. Perhaps setting aside funds ahead of time or scheduling payments early works. You might decide that necessary expenses don’t count as “spending” for the month, but being clear on this keeps things realistic.

One tricky part is handling emergencies or last-minute needs. Think about whether you’ll allow small exceptions or not. Planning this before the month begins helps avoid guilt or confusion later. Trust your tracker’s past data here—you’ll see how often these expenses occur.

Staying on Track During the No Spend Month

Keeping yourself motivated throughout a No Spend Month can sometimes feel like a balancing act. A spending tracker isn’t just for logging expenses—it becomes your daily checkpoint, a reality check that pulls you back when you start drifting. Checking your tracker regularly helps you see progress in real-time. You might notice patterns emerge, like how your urge to spend spikes midweek or after a stressful day. Recognizing these patterns makes it a little easier to prepare ahead and avoid common traps.

Try setting small goals tied to your spending tracker—like hitting halfway through the month without unplanned expenses. Celebrate those wins, even the minor ones. This kind of feedback loop keeps the motivation fresh without feeling forced.

Dealing with Urges to Spend

Temptations almost always sneak up. Maybe you see a sale, or you’re tempted to refresh your wardrobe “just this once.” Tackling these urges means learning to pause and question whether an item truly fits your needs or goals. When you feel the pull, try some of these approaches:

- Wait 24 hours before buying anything that’s not essential—sometimes the urge fades quickly.

- Distract yourself. Take a walk, call a friend, or dive into a hobby.

- Remind yourself of why you started the No Spend Month, especially the benefits you’re aiming for.

It’s not about willpower alone. Sometimes, just understanding why you crave certain purchases uncovers deeper habits or emotions at play. Being curious about your urges rather than judging them might make them less overwhelming.

Using Your Spending Tracker to Stay Accountable

Regularly updating and reviewing your spending tracker isn’t a chore—it’s a way to stay honest with yourself. Every entry you log is a reminder of your commitment. If you slip up, the tracker holds up a mirror without judgment. That’s powerful because it shifts focus from guilt to awareness.

You might find that sharing your progress with a friend or in a community adds another layer of accountability. When someone else knows you’re tracking expenses, it can be easier to resist small temptations. Plus, it’s satisfying to report your successes aloud.

In the end, the tracker is more than numbers—it’s your guide through the month. Use it to spot trouble spots and adjust your approach. It’s okay if things aren’t perfect. Staying on track is about persistence, not perfection.

Reviewing Your No Spend Month Results

Assessing Your Savings

When the No Spend Month wraps up, the first thing to do is look closely at the numbers you’ve been tracking. Your spending tracker becomes more than just a list—it’s a mirror reflecting your habits. Start by comparing your usual monthly expenses to what you actually spent during this period. Subtract to find the difference—that’s your savings. Sometimes it’s eye-opening how much small, daily purchases add up to over a month.

Remember, these saved funds aren’t just extra cash; they represent potential. Maybe paying down debt became more possible, or an emergency fund looked a little healthier. Perhaps you felt a bit of unexpected relief seeing your bank balance stay steady, or maybe not—saving isn’t always thrilling, even when it’s necessary.

Breaking down your tracked data also reveals the real story behind the numbers. Where did you sidestep spending, and where did you slip up? These patterns tell you more than just amounts; they hint at impulses, routines, and sometimes just what you cannot resist.

Lessons Learned and Next Steps

Looking back, there’s often more to take away than just the raw savings amount. Did you realize how certain categories, like takeout or online shopping, were bigger money sinks than you expected? You might’ve found surprising enjoyment in cooking more or finding free activities, or maybe you felt bored and restless, which is also a useful insight.

This reflection helps shape your next steps. You could decide to tweak your habits, like setting a smaller spending limit instead of a strict freeze. Or perhaps you’ll create more detailed budgets based on the insights your tracker revealed. The experience might also spark questions. Why did certain triggers push you to spend? How can you redirect those urges?

It’s a bit of a learning curve, honestly. You might feel like you want to keep the momentum going or feel ready for a break. Both are okay. The key is to turn this data into a pragmatic plan—one that feels doable, not a punishment. Because spending less isn’t the goal in itself; it’s what you do with that change that matters.

Maintaining Healthy Spending Habits

After your No Spend Month, it’s tempting to slip back into old spending routines. But a spending tracker can be your anchor, keeping those good habits alive longer than you might expect. By continuing to log your expenses, you become more aware of where your money goes. It’s not about strict control forever, more like a gentle nudge that makes you pause before spending.

Try to keep it simple—track categories that matter most to you, like groceries or entertainment. If tracking every dollar feels overwhelming, it’s okay to pick your battles. The goal isn’t perfection but consistency. This ongoing awareness can stop small habits from creeping back, like impulse purchases or frequent takeout.

Building a Sustainable Budget

Creating a budget that works long-term isn’t about cutting everything down to the bone. You need some breathing room. When you build your budget, think about your financial goals—saving for a trip, paying off debt, or just having a bit more cushion. Then, add flexible spending categories. Maybe you allow yourself a small “fun fund” each month.

Your budget should feel fair enough so you stick with it. Look at your tracked spending to identify patterns—what costs can shrink, which can stay? Remember, it’s okay to tweak your budget as life changes. Flexibility helps you avoid feeling trapped, which often leads to giving up.

Using Spending Trackers Long Term

Keeping a spending tracker beyond your No Spend Month can feel tedious at times. Still, it’s one of the best ways to keep your financial life in check. Over time, the data you collect becomes a powerful tool. It shows trends, spots wasteful habits early, and helps plan for bigger expenses.

Spending trackers also help with accountability. Checking in with your progress every week or month can keep surprises at bay—no more wondering where your paycheck disappeared. Maybe you’ll notice seasonal expenses or shifts in your income and adapt more easily.

Do you think using a tracker is worth it long term? If you want steady financial control without stress, the answer might be yes. It’s less about restricting your lifestyle and more about making choices that feel deliberate.

Conclusions

Using a Spending Tracker is one of the best ways to make your No Spend Month easier and more effective. It shows you where your money is going and what you can control. When you see all your expenses, you can decide what is important and what is not. This helps you stay focused and avoid surprises.

You have the power to change your spending habits. By following the simple steps and using a Spending Tracker, you can save money and learn more about your finances. Try a No Spend Month with a Spending Tracker and watch how your money habits improve.