Introduction

Starting a No Spend Challenge month means you’ll commit to not spending money on anything unnecessary. This challenge helps you save money and understand your spending habits better. An important tool for this challenge is an expense tracker. It helps you keep a clear record of where your money goes, so you can easily spot areas to cut out spending.

In this article, you’ll learn how to set up an expense tracker designed specifically for a No Spend Challenge month. You will also find practical tips to keep your spending in check and stick to your goals. By using an expense tracker the right way, you can make your challenge a success and build better money habits for the future.

Why Use an Expense Tracker for Your No Spend Challenge

Using an expense tracker during your No Spend Challenge month can make a big difference, even if it feels tedious at first. When you write down every purchase, you start noticing the small things that add up—like that daily coffee or the occasional online impulse buy. These little expenses often slip under the radar until you see them all listed out.

Tracking your spending helps you see where you’re actually slipping up, which makes it easier to cut those unnecessary habits. You begin to understand what “unnecessary” really means in your life, not just from a budget standpoint but emotionally, too. For me, seeing my tracked meals out versus cooking at home made me realize how often I leaned on convenience instead of choice.

Besides spotting waste, logging expenses keeps the challenge real. It’s like a daily check-in with yourself. You can’t just guess how well you did—you have the numbers in front of you. That commitment nudges you to stick with your goal because you’re being more honest, even when you don’t want to be.

Understanding Your Spending Patterns

Reviewing your expense tracker after a week or two gives you a clearer picture of your habits. You might find spending spikes at certain times of day or notice specific triggers that push you into impulse buys. Maybe lunchtime scrolling through social media makes you crave takeout. Or perhaps stress around bill payments leads to small shopping splurges.

Tracking reveals details you didn’t realize mattered. It’s not always about the big expenses, sometimes it’s about the patterns behind them. When I first tracked my spending, I noticed I spent much more on snacks during meetings. That insight helped me bring food from home, which almost completely stopped those small purchases.

What about you? Are there hidden triggers you haven’t discovered yet? Expense tracking almost acts like a mirror, showing where your spending habits start—and where you can adjust.

Staying Accountable to Your Budget

Without an expense tracker, it’s easy to convince yourself that “just this once” won’t matter. But when you see every purchase logged, those small exceptions start standing out. It holds you accountable, like having an extra set of eyes on your spending.

The act of writing down or entering a purchase slows you down too. It gives you a moment to reconsider whether that buy fits the no spend rule or if it’s something you can do without. Often, that pause is enough to stop an impulse.

Expense tracking can feel like a chore, but it’s also a motivator. When you see your progress, it can encourage you to keep going beyond the month. Personally, when I tracked my expenses, I felt less anxious about money because I actually knew where it was going. That clarity helped me stick to my budget instead of creeping over it.

Choosing the Right Expense Tracking Method

When it comes to tracking expenses during a No Spend Challenge, the goal is to keep things simple enough that you actually stick with it. You don’t want a system so complicated it feels like a chore. So, what’s the best way? It really depends on your style and how much time you want to spend logging each purchase—or the lack of them.

Using Digital Expense Tracker Apps

Apps like Mint or YNAB (You Need A Budget) make tracking your spending faster and, well, maybe even effortless. They connect directly to your bank accounts and credit cards, pulling in your expenses automatically. That means you don’t have to type everything out manually, which can be a relief, especially when you’re also trying to keep your spending to zero.

Plus, these apps offer instant updates and notifications, so you might catch slipping up before it grows into a bigger issue. On the flip side, sometimes automatic categorizations can be a bit off. You might have to adjust and check in regularly, which might get annoying. Still, for those who like quick overviews and charts, apps can be a solid option.

Manual Tracking with Spreadsheets or Journals

Manual tracking—whether it’s a spreadsheet or a physical journal—feels different somehow. You actually write down every expense, and that act of recording can turn into a moment of reflection. You might catch yourself mid-write thinking, “Do I really need this?” It slows you down.

Some people find this more effective because it forces engagement. You get a better picture of where your money goes, since it’s not hidden behind automatic entries. But it’s not for everyone. It takes time and discipline to keep it up day after day, and occasionally, you might forget to log something, which messes with your accuracy.

Choosing the right method means balancing convenience with mindfulness. Do you want to glance at trends quickly, or savor the process of noticing every penny? Maybe try both briefly before settling on what fits your habit during the challenge.

Setting Up Your Expense Tracker for the Challenge

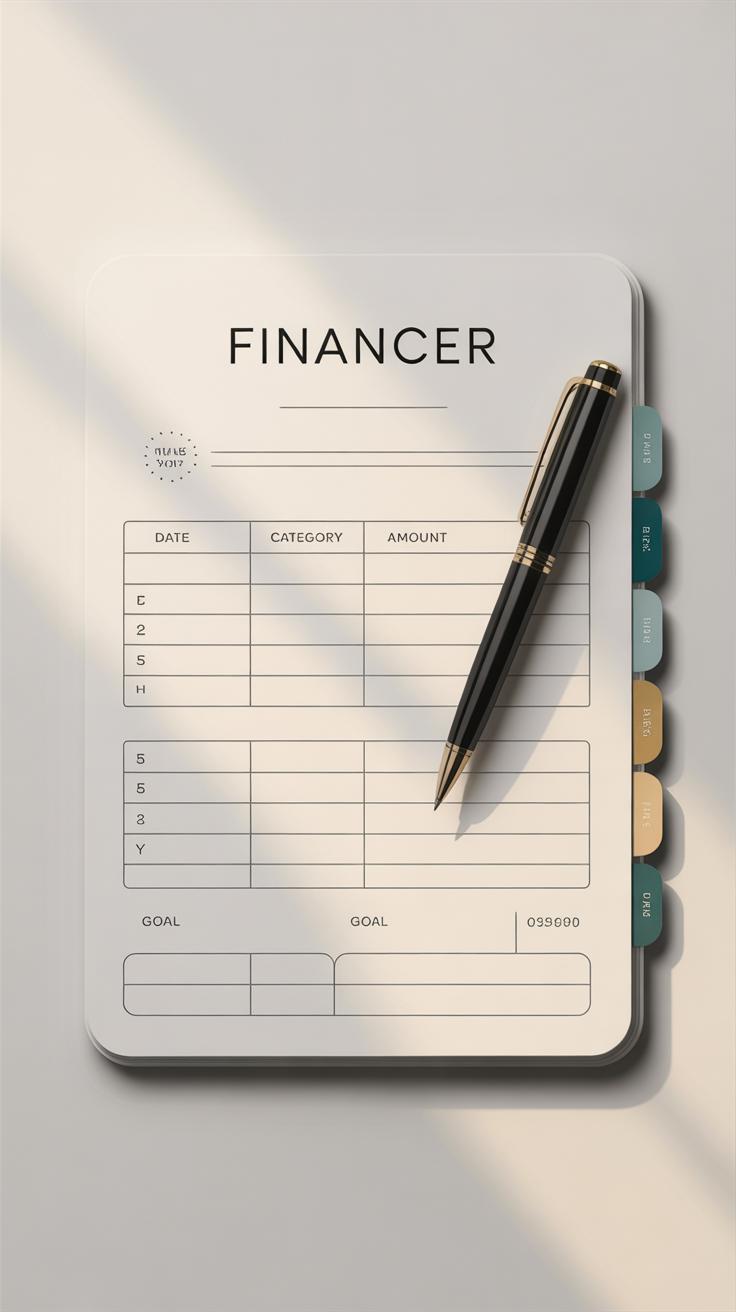

Create Clear Spending Categories

Start by breaking down your expenses into simple, manageable groups. Think about areas where you usually spend money—food, bills, emergencies, maybe some personal care. The goal is to have just enough categories to cover everything, but not so many that it becomes confusing or overwhelming. For example, you might combine all utilities under “Bills” instead of separating electricity, water, and internet. That’s easier to track.

It’s okay if the categories feel a bit rough at first. You can always adjust them later. Some people even include a category for “unexpected essentials” to cover surprises that really do matter and can’t be avoided.

Set Your Spending Limits

Next, decide how much you’ll allow yourself to spend in each category. Since it’s a No Spend Challenge, focus strictly on essentials. Maybe groceries get a modest budget for basics only; bills usually have fixed amounts, so those limits are clear. Emergencies should have some room, but don’t over-allocate—this isn’t a cushion for impulse buys.

Don’t stress too much about getting limits perfect. If you set limits too low and feel restricted, you might give up. Too high, and it defeats the challenge’s purpose. Try to base your numbers on previous spending but trim anything that’s not truly necessary. It’s a balancing act, and adjusting as you go is part of the process. You might discover that some categories need no spending at all during this month.

Tracking Every Expense Accurately

To make your No Spend Challenge work, you really need to note down every expense as soon as it happens. It’s easy to forget a small purchase—like a coffee or a snack—that might seem insignificant but can add up. Waiting until the end of the day or week often means missing those bits and pieces.

Try to keep your tracking tool within arm’s reach all the time. Whether you prefer a phone app, a small notebook, or even a simple spreadsheet, having it ready lets you jot expenses down immediately. You don’t want to be caught without it when you suddenly buy something, right?

Some people find they still miss a few things, despite their best intentions. That’s where receipts and bank statements come in. Reviewing them daily or every few days helps catch any slips. It’s a good habit—kind of like a safety net to make sure your data stays accurate.

It might feel tedious, especially when you’re busy, but this tracking accuracy is what makes the challenge meaningful. Without it, you’re essentially guessing, and that weakens your ability to reflect on your spending habits later.

Using the Tracker to Identify Spending Triggers

Once you’ve diligently recorded your expenses, the next step is to sift through that data and look for clues about when and why you spend unnecessarily during your No Spend Challenge. This part can be surprisingly eye-opening. Patterns will start to emerge, sometimes in ways you didn’t expect.

First, try to spot moments where impulse purchases creep in. Do you notice that certain times of day or particular situations tend to spark urges to buy? Maybe it’s late afternoons when your energy dips, or when you’re out running errands and see something tempting. Sometimes, it’s boredom or stress that nudges you toward the checkout line.

Recognizing these triggers allows you to prepare. Should you bring a distraction like a book for when boredom strikes? Or perhaps carry a water bottle during errands to avoid stopping for convenience drinks? Small habits can make a big difference.

Next, focus on which categories consistently gobble up the bulk of your budget. Maybe dining out or coffee shops show up too often. Or digital subscriptions you barely use but keep renewing. Once you’ve pinpointed these trends, think about cheaper or free alternatives. Could cooking one more meal at home replace a takeout dinner? Can you swap a paid app for a free version? The tracker makes this clear.

You might find some categories aren’t as obvious as you thought. Sometimes the real culprit lies in frequent small purchases that add up quietly. Seeing the numbers laid out helps you question whether those frequent snacks or convenience buys are worth it.

Have you considered how emotional states influence your spending? Tracking won’t tell you everything, but it nudges you to reflect—a crucial step in changing habits.

Adjusting Your Challenge Based on Tracker Insights

Once you’ve been tracking your expenses for a while, the data starts to tell a story—sometimes a bit surprising. You might find that some spending limits you set at the start are either too tight or maybe even too lenient. It’s okay to shift things mid-challenge if it feels necessary. The goal is to make the rules work for you, not to stick rigidly to something that’s impossible or frustrating.

Think about these moments where you felt stuck or tempted. Were they caused by unrealistic goals? Maybe you capped your grocery budget too low, and now you’re buying groceries impulsively outside the planned outings. Adjust that limit—raise it a little to avoid burnout, or set smaller, more realistic sub-limits for individual items.

Here’s a quick way to reassess:

- Review your tracker weekly, not just at the end.

- Spot categories where you repeatedly overspend or struggle.

- Ask yourself if the current limit encourages better habits or just frustration.

- Make small tweaks—try not to overhaul everything at once.

Also, keep notes on what actually worked versus what felt like a chore. These nuggets of insight help shape smarter challenges later on. Say you noticed you always slip up on coffee runs. For your next no spend effort, you can build in a “cheat day” or tweak that category limit to something sustainable.

Adjusting isn’t failing. It’s responding to real-life feedback, which is the whole point of tracking. After all, this is about creating habits you can actually keep, not just surviving a month of impossible rules.

Tips to Stay Motivated and Avoid Common Pitfalls

Sticking to a no spend challenge isn’t always easy. One common mistake is forgetting to track your expenses consistently. It feels tedious at times, and let’s be honest, slipping up happens to most people. But that small slip can easily turn into a bigger detour from your goals. Try setting reminders on your phone or keeping your tracker visible, maybe right on your desk or kitchen counter. That way, you’re less likely to overlook recording a purchase.

Cheating on your limits can creep in too, especially when temptation peaks. Perhaps you tell yourself, “Just this once,” but that once might spiral into several small purchases. Being honest about your spending and forgiving minor mistakes without guilt can keep you moving forward instead of derailing entirely.

Daily Check-ins and Rewards

Checking in daily can make a big difference. It doesn’t need to be time-consuming—just a quick glance at your tracker and a note on how you did. These small touchpoints help keep your goals fresh and real. Plus, setting short daily goals feels less overwhelming than staring at the whole month at once.

Think about small rewards when you hit milestones. Maybe it’s a no-spend treat like a favorite TV show episode or a walk in a favorite park. These tiny incentives can quietly nudge you forward without breaking the bank or your commitment.

Seek Support and Share Your Progress

Sharing your progress turns the challenge into something social. Whether it’s friends, family, or an online community, having someone else know what you’re up to creates a bit of accountability. You might find encouragement from people who understand the struggle or discover unexpected tips from those who’ve been there.

Sometimes just voicing your experience helps—you might feel less alone when cravings strike. Before you know it, those check-ins and shared successes build a support system that keeps your motivation alive, even when it wanes internally.

Reflecting on Your No Spend Challenge Results

After tracking every expense throughout your no spend challenge month, take time to review the whole picture. Look beyond the numbers alone—think about what these figures reveal about your habits and choices. Did you truly avoid impulse buys, or did you just shift spending to allowed categories? What surprised you in your spending patterns? Don’t rush this reflection.

Try breaking down your expenses day by day or week by week. Notice any days where temptation was strongest. Maybe you learned that certain triggers—stress, boredom—push you toward spending. These insights matter just as much as the savings total.

Analyze Savings and Spending Habits

Pull out your total amount spent versus what you normally spend in a month. Do the math carefully—sometimes it’s easier to overlook small, frequent purchases. Compare to previous months and calculate your actual savings.

Think about how your habits changed. Did you cook more at home? Delay non-essential purchases? Or did you find ways to justify some spending? Personal reflection will give you clues about how your relationship with money is shifting—not just the numbers alone.

- What expenses dropped the most?

- Where did your focus shift?

- Did you feel the no spend challenge forced a lasting change or just a short-term adjustment?

Plan Your Financial Path Forward

Use everything learned from the tracker to set your next steps. Maybe you realize you can cut down subscription services or be more mindful about dining out. Or you might find categories where a small budget can reduce cravings and frustration.

Building on your tracked experience, try these:

- Create a realistic budget based on what you discovered works.

- Set clear financial goals with timelines—like saving for an emergency fund or paying off a bill.

- Decide if another no spend month might fit your style or if modified challenges are better.

In any case, your expense tracker isn’t just a record. It’s a tool to learn about yourself and guide smarter financial decisions going forward. And that’s kind of the whole point, isn’t it?

Conclusions

Using an expense tracker during your No Spend Challenge month gives you control over your finances. It shows your spending clearly and helps you stay focused on your goal to save money. Tracking every expense, even small ones, gives you a full picture of your habits.

Keep updating your tracker daily and review your progress regularly. This will help you stay motivated and adjust your plans if needed. The challenge will teach you valuable lessons about money management that go beyond just one month. Your effort today can create long-lasting habits for a healthier financial life.