Introduction

Frugal living means being careful with your money and resources while still enjoying life. It’s about spending less and avoiding waste without feeling like you are missing out. This guide explores how you can practice frugal living with easy steps and smart habits that help you save money and feel satisfied.

In the chapters ahead, you will learn effective strategies for reducing costs in daily life, making wise financial choices, and gaining control over your spending. Whether you want to save for a goal or simply make your money go further, this guide offers practical advice you can start using now.

Understanding Frugal Living

What Is Frugal Living

Frugal living is really about making intentional choices to spend less without feeling like you’re missing out. It means being mindful of where your money goes and focusing on what truly matters to you. For some, it might look like clipping coupons or cooking meals at home instead of eating out. For others, it could mean choosing quality over quantity or repairing things instead of replacing them immediately.

People approach frugality in different ways. Someone might prioritize limiting unnecessary subscriptions, while another might focus on energy-saving habits like turning off lights or using less water. Living frugally doesn’t have to mean deprivation — it’s more about being thoughtful with resources, which can vary widely depending on your lifestyle and values.

The Benefits of Spending Less

Spending less offers benefits beyond just saving money. Here are a few:

- More money in your pocket: You build a cushion for emergencies, travel, or big dreams without feeling stretched thin.

- Less stress: Worry about bills or debt tends to drop when your spending matches your income.

- Control over your life: When you decide how you spend, not habits or impulse, you gain freedom. This helps you focus on what you really want.

- Achieving goals: Whether it’s paying off debt, saving for a home, or investing, frugality creates space to reach those milestones.

That said, frugal living isn’t about being cheap or never enjoying treats. It’s more nuanced — sometimes you might splurge here and save there. The key is balance. Still, it’s easy to misunderstand frugality as simply pinching pennies endlessly, but it’s actually about smarter spending, not less spending.

Setting Your Frugal Living Goals

Why Goals Matter

Having clear financial goals actually makes frugal living feel less like a chore and more like a plan. Goals give you something to aim for, which can keep you motivated when cutting back feels tough. Without them, it’s easy to lose sight of why you became frugal in the first place—sometimes you just end up being cheap without purpose, which isn’t very rewarding.

Goals also help you measure progress. You might think, “I’m saving money,” but how much? What for? When you see results—like finally paying off debt or stacking up an emergency fund—it creates a positive feedback loop. That push can keep you going, even when you’re tempted to splurge.

How to Choose Your Goals

Choosing the right goals isn’t about grand dreams only—it’s about what fits your life right now. Start by asking yourself some simple questions: What are my biggest expenses? What do I value most? What can I realistically cut back on without feeling miserable?

Try to be specific and honest. For example, instead of “save more money,” try “build a $1,000 emergency fund within six months.” It sounds small, but having a precise target helps you plan better.

- Write down your goals and keep them visible.

- Break large goals into smaller, manageable steps.

- Be flexible—your situation might change, and that’s okay.

- Remember, your goals should reflect both your needs and your comfort zone.

At times, you might feel torn between wanting to save aggressively and still enjoying life. That’s normal—and your goals can bridge that gap. Set priorities that let you save but don’t strip away all joy. Finding this balance is, I think, one of the trickiest parts of frugal living.

Creating a Simple Budget That Works

Making a budget doesn’t need to be complicated or overwhelming. The key is to keep it simple enough that you’ll actually use it, without losing track of your money flow. Start by listing your total monthly income—this includes your salary, any side gigs, or occasional earnings you rely on. Once you know what comes in, jot down all your spending. Yes, all of it. Even that small weekly coffee or the impulse buy at the store.

Tracking your expenses can be done in several ways. You might prefer paper and pen, which can feel more tangible and make you slow down when you write. Or, maybe an app fits your style better—there’s no shortage of free or low-cost budget apps that make logging transactions quick. Spreadsheets work well, too, especially if you like seeing things laid out clearly. The best tool is the one you’ll stick with.

As you monitor your spending, you’ll start to notice patterns—or surprises. When that happens, it’s okay to tweak your budget. If you’re spending more on dining out than you thought, consider adjusting your “eating out” category or setting a realistic limit. Conversely, if groceries come out lower than expected, you might redirect funds to savings or debt repayment. The important part is staying flexible and not beating yourself up for mistakes. Your budget is a living plan, not a strict rulebook.

What parts of your spending habits surprise you the most? Keeping a simple budget can reveal more about how you use money—and where you have room to save without feeling deprived.

Cutting Costs Without Feeling Deprived

Saving money doesn’t have to mean cutting out all the things you enjoy. It’s tricky sometimes, but you can trim your everyday expenses and still keep life comfortable, even fun in its own way. Trying out small changes that add up over time often feels less like deprivation and more like smart choices, even if it takes a bit of getting used to.

Start with how you shop. Comparing prices might seem tedious, but it can save more than you expect. Looking for coupons isn’t just for big sales either—sometimes even small discounts help. And, if you can pause before grabbing something on a whim, you might avoid spending on stuff you don’t really need.

When it comes to bills and utilities, switching to energy-saving bulbs or adjusting your thermostat by a degree or two can chip away at higher costs. Maybe you’re skeptical about unplugging devices, but those small habits do add up. Reviewing your regular payments every few months also helps — sometimes you find services you no longer use or catch billing errors.

It’s not always easy to balance cutting costs and still feeling okay with what you keep. But with each practical step, you’ll likely find yourself less focused on what’s missing, and more on what you’ve gained—whether it’s a better sense of control or just more money left in your pocket.

Smart Shopping Habits

Shopping wisely isn’t about endless searching or clipping every coupon you find. It’s about being deliberate and a bit patient. Here’s what tends to work:

- Compare prices online and in-store, especially for bigger purchases. You might find the same product cheaper just by checking twice.

- Use coupons or digital apps, but only if you were already planning to buy the item. Stockpiling unnecessary items isn’t saving.

- Avoid impulse buys by making a list—and sticking to it. If it’s not on your list, give yourself a moment to think before adding it to your cart.

- Consider buying certain items in bulk if you use them frequently. But be honest about what you can realistically consume.

Those little habits can make a noticeable difference over time. I’ve found myself sometimes slipping up—seeing a “good deal” and regretting it later. So, keeping a list or having a clear reason for each purchase seems essential.

Saving on Utilities and Bills

Energy and utility costs tend to sneak up on you if you’re not paying attention. Here are some straightforward ways to lower them:

- Switch to LED bulbs—they cost less and last longer, though the upfront price might feel like a hassle.

- Lower your thermostat in winter and raise it slightly in summer; even a degree or two can affect your bill noticeably.

- Unplug chargers and devices when not in use, because many draw power even when “off.” It’s tedious, yes, but it adds up.

- Review your phone, internet, and streaming services. Are you paying for plans or subscriptions you don’t need? Cancel or downgrade them.

- Seal drafty doors and windows to keep your home temperature steadier, which means less heating or cooling required.

Some of these steps might feel like chores or a bit over the top, but I think the money saved is worth it. Plus, you might notice your home becoming more comfortable at the same time—like a win-win, even if it takes a little effort to get there.

Meal Planning and Cooking on a Budget

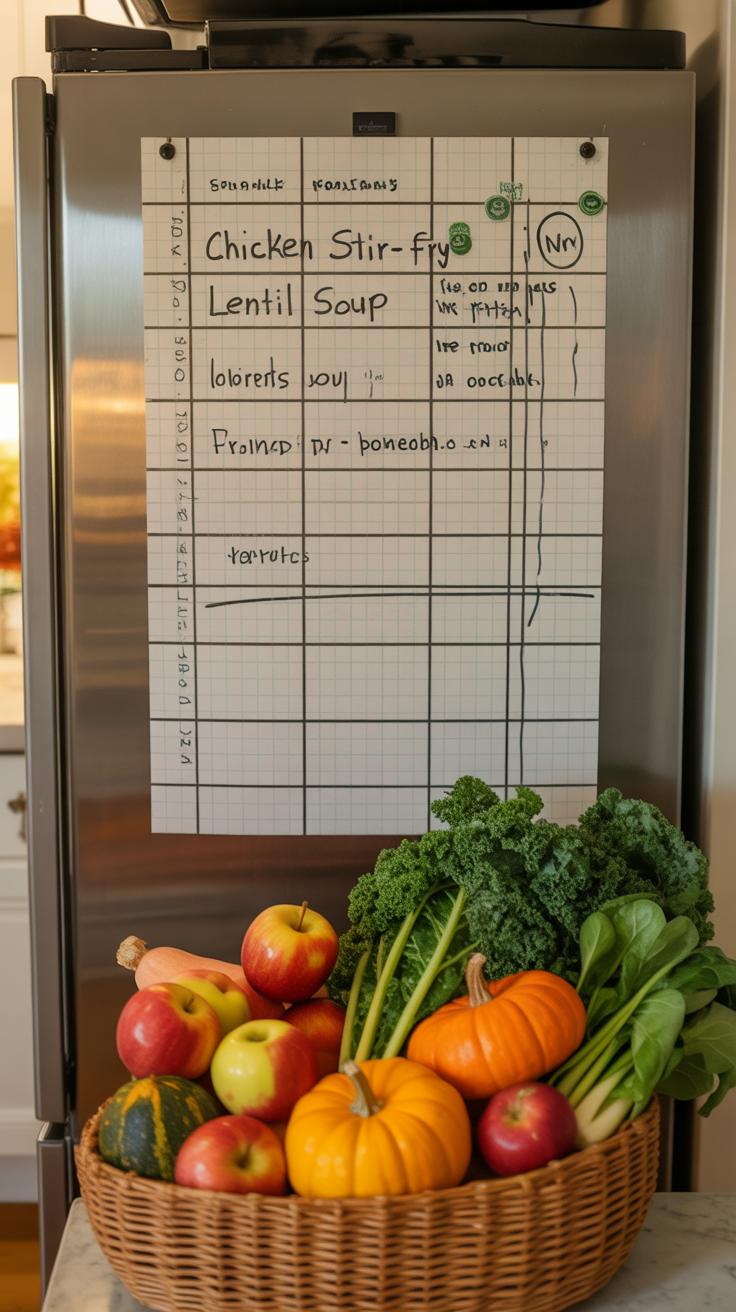

Planning meals can really change how much you spend on food—and not just at the grocery store. When you know what you’re going to cook ahead of time, you tend to buy only what you need, which means less food wasted. I’ve found this kind of planning saves a surprising amount, even if you don’t stick to the plan perfectly.

Here are a few tips to get started with simple meal plans:

- Pick a few affordable staples like rice, beans, eggs, and seasonal vegetables to build meals around.

- Choose recipes that share ingredients, so you’re not buying lots of single-use items.

- Plan for leftovers—some meals actually get better the next day.

Cooking in bulk can cut down time and energy use. When possible, cook enough for a couple of meals and store the rest in airtight containers. You might freeze portions to avoid spoilage. I sometimes forget leftovers in the fridge, but usually, having ready-made food on hand keeps me from ordering takeout, which is way more expensive.

Preserving food doesn’t need special gadgets. A simple set of reusable containers or freezer bags goes a long way. Keeping track of what’s in your fridge and freezer—perhaps with a list stuck on the door—helps prevent surprises and food waste.

Have you thought about how the way you cook and store food affects your grocery bill? Meal planning might feel like extra work at first, but once it becomes routine, it’s hard to overlook the benefits.

Frugal Entertainment and Leisure

Finding Free or Low-Cost Fun

You don’t have to spend a lot to have a good time. Look around your community for free events—farmers markets, art walks, or outdoor concerts often pop up, especially during warmer months. They’re great chances to get out without opening your wallet. Also, don’t underestimate simple outdoor activities like hiking, biking, or a walk in the park. Nature doesn’t come with a price tag, and it can be surprisingly refreshing.

Libraries can be a goldmine for affordable entertainment. Beyond books, many offer free movie screenings, workshops, or even museum passes you can borrow. When I started checking my local library’s calendar, I found myself joining book clubs and craft sessions without paying a dime. It felt like rediscovering a social life without the cost.

Creating Enjoyment at Home

Home can be an enjoyable place, too. Try hosting game nights or movie marathons with family or friends—snacks and laughs don’t need to be expensive. Even solo activities can be fulfilling, like learning a new hobby from free online tutorials, or diving into puzzles and creative projects around the house. Sometimes, these quiet activities turn out to be what you really need after a busy day.

And don’t shy away from mixing it up. Maybe one night it’s a cooking challenge with ingredients you already have, the next is a digital museum tour. These small, affordable shifts in how you spend leisure time can keep things interesting without stretching your budget.

Avoiding Debt and Managing Credit

Why Debt Can Harm Your Finances

Debt is easy to fall into but hard to get out of. When you borrow money, whether it’s a credit card or a loan, you’re not just paying back what you spent—you’re paying extra in interest. That extra cost adds up, sometimes surprisingly fast. It can trap you in a cycle where a big part of your income goes to interest payments instead of things you actually need or want.

Debt can limit your financial freedom. Imagine wanting to save for a vacation or an emergency fund, but most of your money goes to paying off debts instead. It makes it difficult to plan ahead or respond to unexpected expenses. You might feel stuck, even though you’re working hard. It’s frustrating, and it’s why many people say avoiding debt is key to feeling in control of your money.

Tips for Good Credit Use

Having good credit can open doors, but it’s a delicate balance. Using credit responsibly means not spending more than you can afford to pay off each month. That way, you avoid interest piling up and keep your credit scores healthy.

Try these practical steps:

- Pay your balances in full or as close as possible every month to reduce interest costs.

- Set reminders for due dates to avoid late payments, which can hurt your score and add fees.

- Keep your credit utilization low—ideally below 30% of your total available credit.

- Check your credit report regularly to spot any errors or suspicious activity early.

It’s tempting to rely on credit for convenience, but managing it carefully keeps stress down. After all, good credit isn’t just about borrowing; it’s about having options when you need them. What’s been your experience with credit use? Have you noticed how even small habits can change your financial feeling?

Repairing Reusing and DIY

You might be surprised at how much money you can save by simply fixing things instead of tossing them out. Repairing items, like a cracked phone screen or a leaky faucet, avoids the immediate cost of replacement. Plus, it feels a bit satisfying to mend something yourself—even if the result isn’t perfect. It’s not just about saving money; you end up producing less waste, which is a quiet bonus that often gets overlooked.

Reusing materials is another way to cut back on spending. Old jars become storage containers, worn-out clothes turn into cleaning rags, and leftover wood scraps can serve as small shelves. These little actions, simple as they seem, add up over time and often spark creativity. You don’t have to be a craft expert to start—you can try something small.

A few easy DIY projects worth trying:

- Patch small holes in clothing using basic sewing skills

- Create your own cleaning solutions with vinegar, baking soda, and lemon

- Turn old T-shirts into reusable shopping bags

- Repair minor electronics by replacing batteries or fuses

Doing these might feel a bit slow at first. But over time, you could find yourself less dependent on buying new stuff, which, honestly, feels quite freeing.

Being Mindful About Consumption

We often spend without really thinking about why. Maybe it’s boredom, or seeing friends with new stuff online, or just the urge to grab a deal. Recognizing these spending triggers is key to controlling your budget, yet it’s tricky because they sneak up on you. For example, you might notice you shop more after a stressful day or when scrolling through social media. Recognizing these moments helps you pause instead of rushing in.

Try asking yourself a few questions before buying something next time:

- Do I need this, or do I want it right now?

- Will this purchase add value to my life or just clutter it?

- Could I wait a day or two and see if I still feel the same?

Pausing even briefly gives you space to think. Sometimes, the urge fades. Other times, the purchase makes sense, but at least it’s deliberate. Not every spontaneous buy is bad, but mindfulness reduces regret and waste. It’s about balancing needs and wants without feeling like you’re missing out.

This habit doesn’t come naturally for most people. I know I still catch myself justifying some purchases. But the more you practice, the easier it gets to separate urges from intentions. And that, I think, is where real frugality begins—spending with awareness, not impulse.

Keeping Motivation and Tracking Progress

Celebrating Small Wins

When trying to stick to frugal habits, small victories matter more than you might expect. Saving even a few dollars here and there or skipping an impulse buy can feel like a drag — but what if you paused to notice those wins? Recognizing this progress turns saving from a chore into something kind of rewarding.

Think about the feeling you get after paying off a tiny debt or reaching a modest savings goal. That sense of accomplishment fuels your motivation. It’s like giving yourself permission to keep going, even if the overall journey feels slow or uncertain. Sometimes I forget this myself and focus too much on what I haven’t saved yet, which just leads to frustration. Celebrating small wins helps flip that mindset.

You don’t have to throw a party every time, but maybe a quick note or a moment of appreciation for those wins. It reminds you why you started and shows you’re capable of sticking with it.

Using Tools to Track Your Success

Tracking your savings and goals makes staying motivated easier. Whether it’s a simple notebook or a digital app, having a place to record your progress keeps things visible. When you see numbers moving in the right direction, it’s harder to lose steam.

Apps like Mint or YNAB help categorize spending, set budgets, and spotlight where you’re actually saving money. If apps feel too much, a bullet journal or paper chart works just as well. Sometimes I jot down a couple of expenses daily and tally them weekly — it feels more real than numbers on a screen.

Tracking also reveals patterns. Maybe you save a lot on groceries one month but overspend on dining out. Noticing this helps adjust habits without feeling like you’re blindly cutting back everywhere.

Which method do you think fits your style? The key is regular review—don’t just record and forget.

Conclusions

Living frugally is not about giving up what you enjoy. It’s about making thoughtful choices that stretch your money and bring value to your life. By cutting unnecessary costs and focusing on what matters most, you create space for both savings and happiness.

As you adopt frugal habits, you will find yourself more aware of your spending and better able to meet your financial goals. Remember, frugal living is a journey that builds over time, helping you live well today and prepare for tomorrow.