Introduction

Crafting a solid wealth strategy is crucial for safeguarding financial security and achieving long-term goals. With today’s changing economic landscape, wealth management requires a blend of careful planning, smart investments, and proactive risk management. For individuals looking to protect and grow their wealth, a well-structured plan ensures that personal finances remain resilient and adaptable.

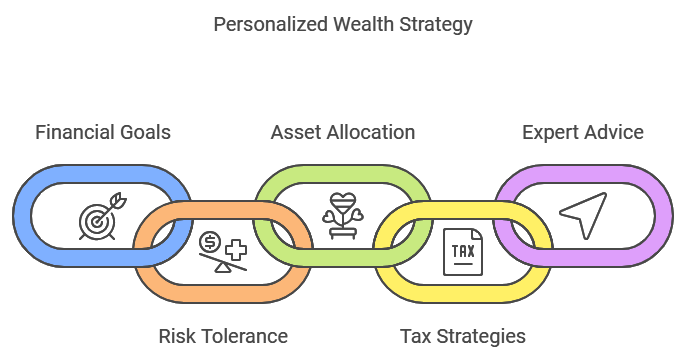

In this guide, we’ll explore the foundational steps needed to build and maintain a strong financial position, including personalized wealth strategies, foundational financial planning, diverse income sources, and sustainable investment choices. By considering aspects like risk tolerance, asset allocation, and tax-efficient planning, individuals can confidently navigate their wealth journey, making choices that secure their financial future.

Key Takeaways

- Craft a personalized wealth strategy that aligns with unique financial goals and risk tolerance.

- Establish a strong financial foundation with emergency funds and effective debt management.

- Diversify income through passive sources and side hustles for added financial security.

- Focus on long-term investments and a balanced portfolio for sustainable wealth growth.

- Leverage tax-efficient planning to maximize asset protection and growth.

- Regularly review and adjust financial strategies with professional guidance for ongoing stability.

Crafting a Personalized Wealth Strategy

A well-tailored wealth strategy looks into an individual’s unique financial landscape, helping to ensure long-term growth and stability. This approach combines comprehensive wealth management with personalized planning strategies, aligning investments with an individual’s risk tolerance, lifestyle goals, and future aspirations. Collaborating with a tax advisor can provide specific actionable insights, especially in areas akin to tax planning, asset allocation, and life insurance policies. This customization roadmap safeguards family wealth, allowing clients to make informed decisions that meet their financial objectives. Including the charitable giving and philanthropy thoughtfully integrated, offering avenues for clients to achieve financial success while supporting causes that matter to them. With resources like an IRA and annuity options further strengthens the strategy, balancing immediate financial security with long-term growth.

Setting Financial Goals for Your Wealth Strategy

Creating a wealth strategy starts by identifying personal financial goals that match long-term aspirations. Whether planning for retirement, funding education, or managing estate planning, understanding these goals allows for a clear and structured approach. A wealth advisor can help outline actionable steps, incorporating investment vehicles like IRAs, 529 plans, or tax-advantaged accounts. This approach helps reduce tax liabilities while growing wealth. Clients who work closely with their advisors gain insights into their unique portfolio needs, allowing them to make strategic decisions that protect and expand their assets over time.

Understanding Risk Tolerance and Portfolio Allocation

Risk tolerance is key to shaping a personalized investment approach. By aligning investments with one’s comfort level and financial goals, individuals can balance growth opportunities with asset protection. This balance is achieved through a tailored mix of stocks, bonds, and other investment assets that match personal risk tolerance. A wealth advisor can provide valuable insights on adjusting asset allocations to optimize performance without exceeding acceptable risk levels, ensuring that the portfolio remains resilient and capable of weathering market shifts.

Key Components of a Personalized Wealth Strategy

1. Define Clear Financial Goals

Setting specific, measurable goals for wealth management is essential. Whether aiming for retirement savings, funding education, or expanding investments, well-defined goals provide direction and clarity for strategic planning.

2. Evaluate and Adjust Risk Tolerance Regularly

Risk tolerance may shift over time due to personal or market changes. Regularly assessing risk levels ensures that portfolio allocations remain aligned with current financial circumstances, helping to prevent unexpected losses.

3. Optimize Asset Allocation for Stability

A well-balanced mix of assets, such as stocks, bonds, and real estate, promotes portfolio stability. Optimizing asset allocation to reflect both personal goals and market trends helps safeguard investments while supporting growth.

4. Incorporate Tax-Efficient Strategies

Using tax-advantaged accounts and minimizing liabilities through careful planning can maximize net returns. Strategies like tax-loss harvesting or contributing to retirement accounts reduce tax burdens and enhance long-term wealth.

5. Seek Expert Advice for Strategic Guidance

Working with a wealth advisor offers access to specialized insights and tailored recommendations. Financial experts help navigate complex decisions, ensure alignment with financial goals, and adapt to evolving market conditions.

Building a Strong Financial Foundation

Building wealth starts with a solid financial base—like setting up an emergency fund and managing debt wisely. An emergency fund acts as a financial cushion, giving some breathing room for unexpected expenses and promoting financial stability. Staying on track with a budget and focusing on paying off high-interest debts are small but powerful steps toward effective cash flow management. These basics don’t just protect financial assets; they pave the way for bigger wealth building goals. To dig deeper or get guidance, feel free to contact us. We’re here to offer tax advice and tax services tailored to your needs, so you can set the stage for steady, long-term financial growth.

Establishing an Emergency Fund for Financial Security

An emergency fund is a critical component of financial security, serving as a buffer against unexpected expenses. Experts recommend saving at least three to six months of essential living costs to protect against disruptions like job loss or medical emergencies. This fund allows individuals to handle unforeseen events without derailing long-term goals. Building an emergency fund promotes confidence and financial independence, providing a solid foundation for wealth-building endeavors. Incorporating this into a comprehensive wealth plan ensures that individuals remain prepared for life’s uncertainties.

Strategies for Effective Debt Management

Effectively managing debt supports a healthier financial foundation. High-interest debts, such as credit card balances, should be prioritized, as they quickly accumulate interest. A structured debt repayment plan not only reduces financial stress but also improves credit standing, paving the way for future financial opportunities. By reducing liabilities through consistent repayment, individuals can direct more resources toward investments and savings, reinforcing the core pillars of a stable financial plan and supporting their long-term wealth goals.

Case Study: Building a Strong Financial Foundation through Effective Debt Management

Sarah, a small business owner, found herself struggling with high-interest credit card debt, which limited her ability to save and invest. Concerned about her financial future, she consulted with a wealth advisor to develop a debt management plan that aligned with her long-term goals. Her advisor recommended prioritizing her highest-interest debts first, followed by setting up an emergency fund equal to three months of expenses.

Within a year, Sarah saw significant improvement. Her debt decreased substantially, and she had a growing emergency fund to fall back on during unexpected expenses. With a stronger financial foundation, Sarah could now focus on expanding her business, all while building toward her wealth goals. This case highlights the importance of structured debt management and emergency planning in achieving financial security.

Expanding Income through Diverse Channels

For those aiming to protect and grow wealth, diversifying income sources can offer significant stability. By exploring passive income opportunities, such as real estate investments or dividend-paying stocks, individuals reduce reliance on a single income stream. Additional earnings from side businesses or freelance work further support wealth growth, allowing for more substantial asset accumulation over time. Such diversification not only builds financial resilience but also paves the way for long-term wealth sustainability.

Exploring Passive Income Streams for Wealth Growth

Diversifying income with passive sources, like rental properties or dividend-paying stocks, supports financial resilience. These income streams offer stability by adding layers of earnings that don’t rely on active work, reducing dependence on a single paycheck. Passive income provides consistent returns over time, helping individuals reach their wealth goals with less volatility. Pursuing these opportunities requires careful planning and ongoing adjustments, often with guidance from a financial advisor who can advise on the best options suited to one’s goals.

Leveraging Side Hustles for Additional Earnings

Side hustles provide an accessible way to supplement income, often by monetizing personal skills or hobbies. From freelancing to starting small businesses, these additional income sources help individuals build wealth while diversifying their financial profile. Exploring side hustles empowers individuals to achieve financial independence and opens doors to new skills and experiences. Moreover, consistent earnings from side endeavors allow for faster asset accumulation, complementing traditional investments and promoting long-term financial security.

“Don’t put all your eggs in one basket.” — Warren Buffett

Growing Wealth with Long-Term Investment Choices

Long-term investment strategies form the backbone of sustainable wealth growth. A diversified portfolio, combining assets like stocks, bonds, and real estate, helps mitigate risks while offering the potential for compounded returns. Maintaining a long-term perspective on investments, guided by a seasoned wealth strategist, empowers individuals to navigate market fluctuations effectively. This approach supports a stable financial future, making it easier to achieve personal and financial goals, even in uncertain times.

Diversifying Investments for Sustainable Growth

A diversified investment approach spreads risk across various asset classes, creating a resilient portfolio. By allocating assets like stocks, bonds, and real estate, individuals can capitalize on different growth potentials while minimizing exposure to market downturns. This balanced approach is essential for sustainable wealth growth, enabling clients to navigate economic shifts more confidently. Financial advisors often recommend diversification as a core strategy, as it supports steady, long-term returns and aligns with prudent risk management practices.

The Importance of Patience in Investment Success

Long-term wealth growth is heavily influenced by patience and consistency. While it can be tempting to react to short-term market changes, holding investments for an extended period allows for compounding gains. This strategy is particularly effective with assets that exhibit steady growth, such as blue-chip stocks or index funds. By focusing on long-term returns rather than daily market shifts, individuals can build wealth with a steady, reliable approach, aligning their strategy with broader financial goals and avoiding the pitfalls of market timing.

Conclusion

Building and protecting wealth isn’t just about financial growth; it’s about establishing a secure foundation that aligns with personal goals and values. By implementing a personalized wealth strategy, diversifying income streams, and making informed long-term investments, individuals can safeguard their financial future and navigate life’s uncertainties with confidence.

A proactive approach, paired with regular adjustments and professional guidance, empowers individuals to achieve both short-term stability and long-term growth. Whether through effective risk management, tax-efficient planning, or strategic investments, a comprehensive wealth plan ensures that assets are preserved and allowed to flourish, creating lasting financial security for years to come.