Introduction

Saving money can feel hard, but it doesn’t have to be. This month, you can try simple steps that make a real difference. Saving a little bit regularly adds up fast. These tips focus on what you can do right now to keep more of your money without changing your life too much.

We explore easy actions and smart moves that anyone can use. From cutting small daily costs to rethinking spending habits, you will learn practical ways to build your savings quickly. Ready to find out how to save money that actually works this month?

Track Your Spending to Find Saving Opportunities

Knowing where your money goes is arguably the most useful step toward saving. You can’t fix a problem if you don’t see it clearly, right? Tracking daily expenses shines a spotlight on those little purchases that add up and often slip under the radar.

Keep a Daily Spending Log

This doesn’t have to be complicated. Just jot down every purchase—big or small—in a notebook or use your phone’s note app. Maybe it’s a coffee, a snack, or an impulsive app purchase. Writing these down puts a kind of pause on spending that you might not expect. Suddenly, you see patterns, like a daily $3 snack turning into over $80 a month. It’s a bit tedious, sure, but once you get into the groove, it feels like a mild reality check that’s hard to ignore.

Use Budgeting Apps to Monitor Costs

If the manual method feels like too much, apps can help. They link to your bank accounts and cards, automatically tracking expenses while showing you where overspending happens. Apps like Mint or YNAB (You Need A Budget) are popular and free to try. They break things down visually, which makes it easier to spot odd habits—like how subscription charges sneak in or impulse buys pop up around payday. Some people find these apps feel invasive at first, but after a few weeks, they often see it as an eye-opening tool that keeps their spending honest.

Cut Unnecessary Subscriptions and Memberships

You might be surprised how many subscriptions quietly drain your account every month. Some streaming services, apps, magazine memberships—you may have signed up for them at some point and just forgot they exist. It’s pretty common, actually. I’ve found that just by reviewing my monthly bank and card statements, I uncover a few charges I barely recognize or no longer use.

Review Bank and Card Statements Monthly

Take some time each month to scan through your statements. Look out for recurring charges, especially those small ones that seem harmless but add up over time. Here’s a quick checklist you can follow:

- Identify all monthly recurring payments

- Spot any services you haven’t used recently

- Note trial periods that may have rolled into paid subscriptions

- Compare charges against your actual usage

Sometimes, you don’t even realize certain subscriptions slipped in—like that premium app you tried once or a forgotten gym membership you never canceled after moving. Spotting these is key because these payments sneak past without much thought.

Cancel Services You Don’t Use

Once you know which services are unnecessary, cancel them. It might feel like a hassle—sometimes websites hide the cancellation button or make you jump through hoops. But most let you pause or stop subscriptions with just a few clicks if you dig a bit. Focus on keeping only the services that bring real value.

Imagine saving $10 here, $15 there—it’s easier than you think and almost painless once you get the hang of it. Plus, freeing yourself from useless subscriptions means more cash stays with you, not the companies you barely interact with. Have you checked your statements lately? Maybe it’s time to do that before the next billing cycle hits.

Plan Meals and Avoid Eating Out Frequently

Create a Weekly Meal Plan

When you plan your meals before hitting the grocery store, you reduce those last-minute impulse buys that can quickly add up. It’s surprising how many times I’ve wandered through the aisles, grabbing snacks or ingredients that didn’t really make sense with what I already had at home. Making a weekly meal plan changes that habit. You start with meals you know you’ll actually eat, then build your shopping list around those dishes. This way, your grocery list isn’t random but tied directly to your meals.

Try this: write down breakfasts, lunches, dinners, and even snacks for the week. Then check your pantry and fridge to avoid buying duplicates. Keeping the list focused means less food waste—and less money down the drain. I think it’s a bit like having a mini-contract with yourself. You kind of commit to using what you buy.

Cook at Home More Often

Cooking at home may sound obvious, but it really makes a difference. Eating out frequently can blow your budget faster than you expect. Even simple home-cooked meals can save you a lot—especially if you avoid complicated recipes that need unfamiliar ingredients. Plus, cooking at home lets you control portions, reduce unhealthy extras, and enjoy a quiet moment that eating out rarely offers.

Batch cooking can save both time and money. Make a big pot of something versatile like chili or stew, then portion it out for several meals. That way, on busier days, you’re not tempted to order takeout because preparing dinner feels like too much work. Do I always stick to this? No. But when I do, it’s surprising how much I save, and I usually feel better about what I eat, too.

Shop Smart by Comparing Prices and Using Discounts

Before you grab that item off the shelf or click ‘buy now,’ it’s really worth checking prices nearby—and online too. Sometimes, two stores a few blocks apart can have a big difference in price for the exact same product. I’ve lost count of how many times I thought I was snagging a bargain only to find it cheaper elsewhere after the fact.

Take a moment to jot down what you need and don’t rush. It might feel tedious, but the savings can add up quickly. Websites and apps can help compare prices in an instant. Even if it takes a few extra minutes, finding the best deal often pays off.

Coupons are another simple way to cut costs. You can find them clipped in newspapers, or more often now, digitally on store websites or coupon apps. Have you tried scanning your phone at checkout with a loyalty card? Stores usually reward return customers with discounts, points, or special sales—sometimes these perks sneak past if you don’t sign up.

Using all these together—price checks, coupons, and loyalty programs—makes a difference. You might not save a fortune on every single purchase, but the little bits add up. And isn’t that what saving money is about? Small wins that keep more cash in your pocket throughout the month.

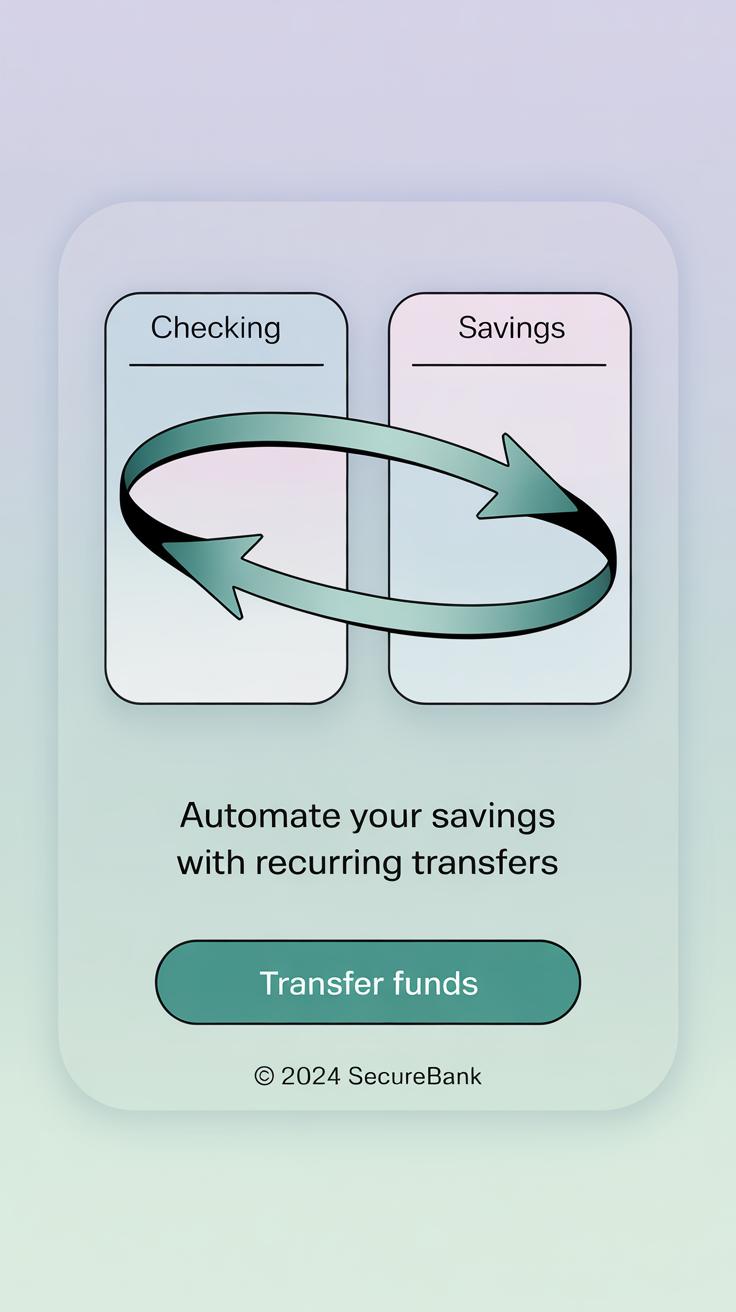

Set Up Automatic Transfers to Your Savings

One way to make saving almost effortless is by automating the process. When you set up automatic transfers, the money moves into your savings account before you even have a chance to spend it — which is kind of the point, right? It’s like paying yourself first, making sure your savings grow quietly in the background while you handle the rest of your expenses.

Choosing the right amount to transfer is a bit tricky. You don’t want to pick a figure that feels like a burden and forces you to cut too much from daily essentials. Think about a fixed amount or maybe a percentage of your paycheck that feels manageable — something you barely notice leaving your checking but still adds up over time.

Online banking makes setting this up quite simple. Most banks let you schedule recurring transfers, so you just decide on the day and amount, and the system does the rest. It’s worth spending a few minutes navigating your bank’s app or website to set it up once — then you don’t have to think about it, really.

Have you noticed how small, consistent deposits can build up faster than occasional, larger ones? It’s a subtle difference but makes a big impact. Maybe test different amounts until you find what actually sticks without stress.

Reduce Energy Costs by Changing Small Habits

Making small changes around your home can quietly shrink your electricity and heating bills. It’s surprising how much you can save just by being a bit more mindful. For instance, turning off lights when you leave a room might sound obvious, but many people still overlook it. Those few extra minutes your lights stay on do add up.

Unplugging devices or switching off appliances completely—rather than leaving them on standby—is another easy win. Think about your phone charger, TV, or even the microwave clock that’s always blinking. These draw power even when you’re not actively using them. I’ve read that unplugging just a handful of gadgets can cut your monthly electric bill by a noticeable margin. Maybe that’s something worth trying?

Then there’s heating and cooling. Setting your thermostat just a couple of degrees lower during winter, or higher in summer, can make a difference. It might feel a bit uncomfortable at first, but layering clothes or using a fan often helps. Plus, your heating or air conditioning won’t have to work as hard, which saves money. I sometimes hesitate because adjusting the thermostat feels like trading comfort, yet it’s also a way to keep more cash in your pocket.

So, what small habit could you start changing today? Turning off one extra light? Unplugging a device after use? Or maybe just being okay with a slightly different thermostat setting? Little shifts like these add up over time, and you might be surprised how quickly they pay off.

Buy Quality Products That Last Longer

It might seem tempting to grab the cheapest pair of shoes or the least expensive kitchen gadget, especially when money feels tight. But think about what happens a few months later—you’re replacing those items again and again. That adds up. Choosing well-made shoes, clothes, or kitchen tools can feel like a bigger expense upfront, but over time, it often saves you more. You don’t have to keep buying something that falls apart quickly.

Take a good pair of shoes. Yes, they might cost more at first. But if they stay sturdy for a couple of years instead of a few months, that’s money saved. Same goes for clothes—bargain items may stretch or fade fast, while quality fabrics hold up better. Kitchen tools that last might look pricey, but you avoid the hassle and cost of frequent replacements.

To figure out whether that more expensive product is really worth it, try calculating the cost per use. Just divide the price by how long you expect to use it. For example:

- A $100 jacket that lasts 5 years costs about $1.67 per month.

- A $30 jacket that lasts 6 months costs $5 per month.

This way, you get a clearer picture beyond the initial price tag. Sometimes spending more now means spending less later. It’s not always an easy call, though—sometimes you might not want to invest heavily if you aren’t sure how often you’ll use an item. But when you do, try to lean toward durability.

Create a Financial Goal and Track Progress

Setting a clear, specific savings goal can make a real difference in your motivation to save. Instead of just thinking “I want to save money,” decide on a number and a purpose. For example, aim to save $500 this month for an emergency fund, a new appliance, or even to pay down debt. Having a target like this gives your efforts more meaning. It’s easier to say no to unnecessary spending if you’re mentally moving toward something tangible.

Try breaking your bigger goal into smaller chunks. Saving $100 per week feels more doable than staring at a five-hundred-dollar sum all at once. And once you reach these smaller steps, you get a mini sense of success, which… honestly, keeps you going.

Set a Specific Savings Goal

Think carefully about what you want to save for and how much you really need. Ask yourself:

- Is this a short-term goal, like covering this month’s unexpected car repair?

- Or is it something longer-term, like next year’s vacation?

- Will saving this amount affect other bills or expenses?

Being precise about the purpose guides your choices, from spending habits to daily priorities. Ambiguous goals often lead to procrastination. So, if you say, “I want $200 for gifts in six weeks,” you’ll have a clearer path than “save some money.”

Review Your Progress Regularly

Checking your savings frequently, say weekly or biweekly, keeps you aware of your standing. It doesn’t have to be stressful or a big deal—just a quick glance at your bank app or a note on a spreadsheet. You might realize that you saved more than planned one week, which could allow some slack the next. Or maybe you fell short and need to rethink your budget for the rest of the month.

Adjusting your plan isn’t about failure; it’s about staying realistic and flexible. Maybe you want to try cutting back a little less on groceries but skip takeout instead. Keeping an eye on your progress helps you spot what works and what doesn’t. Often, you’ll find the best strategy comes from trial, error, and honest reflection.

Conclusions

Saving money is a skill you build over time. Starting with easy actions creates a strong base. From tracking your spending to using smart purchasing strategies, every step helps you keep more money. The key is to stay consistent and make saving part of your daily life.

Try these tips one by one and see what fits your routine. Adjust and grow your savings method as you go. You can make progress this month and beyond by taking control of your finances now.