Introduction

Buying a used boat or considering a boat loan can be an exciting decision, but it’s important to understand whether this is a sound financial investment. Many prospective buyers wonder if the purchase of a boat is a good move. While ways to make the most of your boat ownership do exist, the reality is that boats often depreciate rapidly, and their value can decline significantly over time. Whether you’re looking at a new or used boat, it’s crucial to assess the long-term costs and benefits, especially if you plan to make a profit from your investment.

Deciding whether owning a boat is worth it depends on multiple factors, including your monthly boat loan payments and ongoing maintenance costs. Boat ownership isn’t just about the initial purchase; it involves regular upkeep to ensure your investment doesn’t turn into a money pit. Whether you’re buying your first boat or adding to a fleet, understanding the true cost of ownership is key.

Key Takeaways

- Boats often depreciate quickly, making the initial purchase just the beginning of the expenses related to boat ownership.

- Personal enjoyment may outweigh the financial return, but it’s crucial to weigh this against the economic realities of owning a boat.

- Understanding the long-term costs, including ongoing maintenance and marina fees, is essential before purchasing a boat.

- Depreciation plays a major role in the declining resale value of a new boat, especially in the early years of ownership.

- The choice between a yacht and a standard boat depends on your usage, budget, and ability to manage higher maintenance and insurance costs.

- Carefully evaluating whether boat ownership aligns with your financial goals can help prevent turning your investment into a money pit.

Is Buying a Boat a Good Investment? Understanding the Real Value

Buying a boat can be an exciting venture, but is it really a good investment? The value of a boat often lies in its use rather than its monetary return. While a new boat can provide endless enjoyment, it’s essential to understand that boats typically depreciate over time. Unlike real estate, where property values might increase, boats often lose value quickly. This depreciation means that the initial purchase price is just the beginning of the costs associated with boat ownership. Many boat owners find that the real investment is in the experiences they gain, not in the boat’s financial return. Therefore, it’s crucial to weigh the personal enjoyment against the economic realities before deciding if a boat is a good investment for you.

Key Considerations When Deciding to Buy a Boat

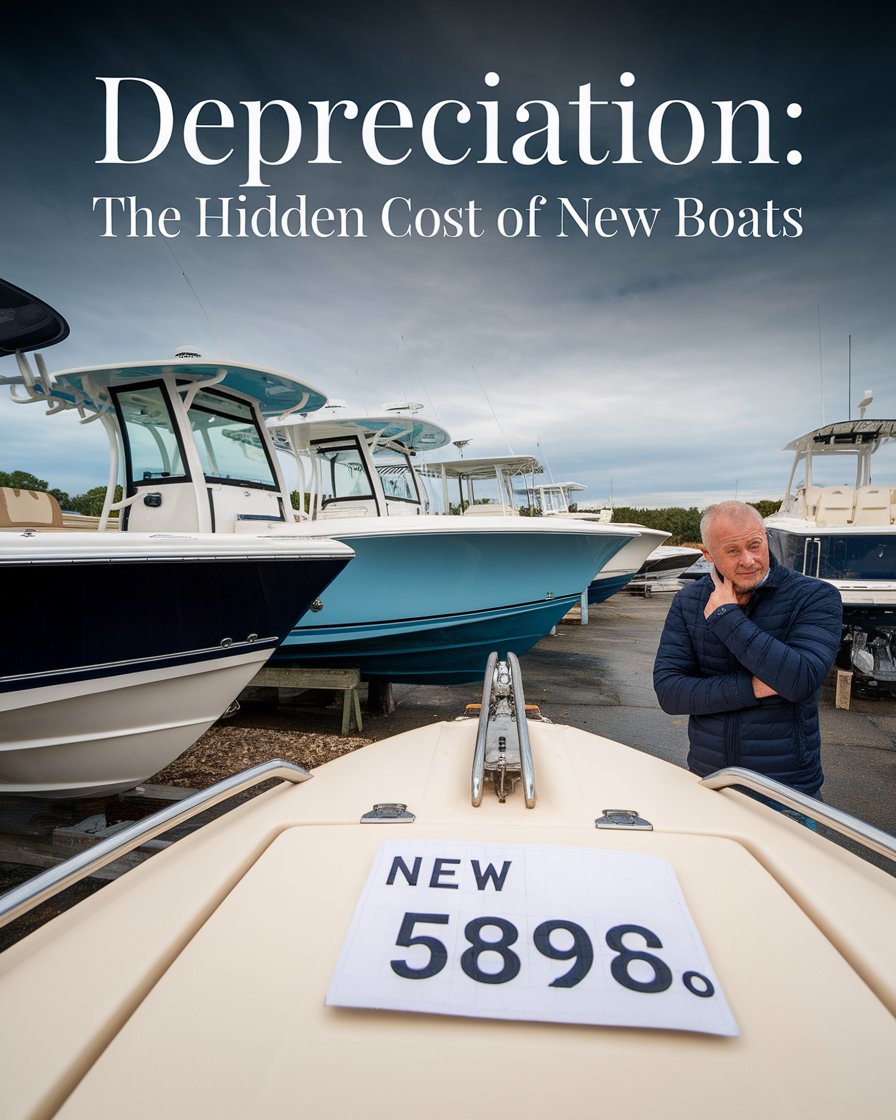

1. Depreciation: The Reality of Buying a Boat

When you buy a boat, expect it to depreciate quickly, especially in the first few years, which can impact its value significantly.

2. Ongoing Expenses: More Than Just a Purchase

Owning a boat comes with additional costs beyond the initial purchase. These include maintenance, insurance, and storage, all of which can add up.

3. Balancing Enjoyment with Costs

While buying a boat might not be the best financial investment, the enjoyment and experiences it offers can make it worth the expense.

4. Consider Other Investments

Before you buy a boat, think about whether it’s the right choice for your financial goals, or if other investments might be better suited.

5. The Experience Factor

For many, the true investment in a boat is in the quality time spent on the water, making memories that last a lifetime.

Balancing Personal Enjoyment with Financial Considerations

When considering whether to buy a boat, it’s important to balance personal enjoyment with financial realities. Owning a boat can offer incredible leisure opportunities, from weekend getaways to fishing trips. However, these experiences come at a cost. Boats require regular maintenance, insurance, and storage, all of which add to the financial burden. While the memories made on the water can be priceless, it’s essential to evaluate if these experiences justify the ongoing expenses. Many boat owners find that the joy of being on the water outweighs the costs, but this decision is deeply personal. Carefully assessing how often you’ll use the boat and what value it brings to your life can help you decide if the investment is worth it.

Understanding the Long-Term Costs of Boat Ownership

Beyond the initial purchase, owning a boat involves ongoing expenses that can impact your finances over time. Maintenance, storage, and insurance are just a few of the costs that boat owners must regularly consider. Unlike a one-time purchase, these recurring expenses can add up, making the overall cost of boat ownership substantial. For many, these costs are manageable and well worth the enjoyment the boat provides. However, if not carefully budgeted, they can strain your financial resources. Understanding these long-term costs is crucial in determining whether buying a boat is a sound financial decision. By planning for these expenses, you can enjoy boat ownership without unexpected financial stress.

Exploring the Depreciation of New Boats: What You Need to Know

When you buy a new boat, depreciation is an inevitable factor that must be considered. Unlike cars, which also depreciate but can still hold some value over time, boats often lose their value more rapidly. This is particularly true for new boats, where the depreciation rate can be steepest in the first few years. Understanding this can help prospective buyers make informed decisions about whether to invest in a new boat or consider a used one. The depreciation of a boat can affect its resale value, and it’s important to keep this in mind when calculating the long-term costs of ownership. Knowing how quickly a boat depreciates can guide you toward making a smarter purchase.

Case Study: Depreciation and Resale Value of New Boats

A comprehensive study by BoatUS examined how different factors impact the depreciation and resale value of new boats. The study followed various boat brands over a ten-year period, focusing on how brand reputation, maintenance, and usage affected their value. Notably, boats from premium brands like Boston Whaler depreciated at a slower rate compared to lesser-known brands. For instance, a Boston Whaler retained approximately 70% of its original value after five years, whereas a lesser-known brand might retain only 50%. This highlights the importance of considering brand reputation and maintenance practices when purchasing a new boat, as these factors significantly influence long-term value and potential resale outcomes.

The Impact of Depreciation on Resale Value

Depreciation plays a significant role in the resale value of your boat. A new boat often loses value quickly, especially within the first few years of ownership. This rapid depreciation can be a shock for those who expect to recoup a significant portion of their initial investment. Understanding how depreciation affects resale value is crucial when considering the long-term financial impact of buying a new boat. While some boats retain value better than others, most will experience a steep decline in worth over time. This depreciation should be factored into your decision-making process, especially if you plan to sell the boat in the future. Knowledge of depreciation trends can help you make a more informed purchase.

Factors Influencing the Depreciation Rate

Several factors influence how quickly a boat depreciates, including its brand, condition, and usage. Premium brands may hold their value better, but even they are not immune to depreciation. Regular maintenance and care can slow down the depreciation process, making your boat more attractive to future buyers. Usage also plays a role; boats that are heavily used tend to depreciate faster. Understanding these factors can help you make smarter decisions when buying a new boat. By choosing a well-maintained, reputable brand and carefully managing its use, you can minimize depreciation and maintain a higher resale value.

Marina and Maintenance: The Hidden Costs of Boat Ownership

Owning a boat comes with more than just the initial purchase price; there are significant ongoing costs that can catch new boat owners by surprise. Marina fees, for example, can vary widely depending on location and the size of your boat. Regular maintenance, which includes everything from engine checks to hull cleaning, is another essential aspect of boat ownership that requires budgeting. These hidden costs can add up quickly, making it crucial for potential buyers to factor them into their decision. Without proper planning, the joy of owning a boat can be overshadowed by the financial strain of upkeep. By understanding these costs upfront, you can better assess whether boat ownership is financially feasible.

Understanding Marina Fees and Storage Costs

One of the hidden costs of boat ownership is the expense of marina fees and storage. Depending on where you live and where you choose to keep your boat, these fees can vary significantly. Coastal areas and popular lakes often have higher marina fees due to demand. Additionally, the size of your boat will also influence these costs, with larger boats requiring more space and, therefore, higher fees. Storage costs can also add up if you need to keep your boat in a dry dock or another facility during the off-season. It’s important to factor in these costs when calculating the total expense of owning a boat. Proper planning for these fees can help prevent financial surprises.

The Importance of Regular Maintenance

Regular maintenance is critical to keeping your boat in good condition and avoiding costly repairs down the line. From engine checks to hull cleaning, ongoing maintenance tasks are necessary to ensure your boat’s longevity and performance. Neglecting maintenance can lead to more significant problems, including engine failure or hull damage, which can be expensive to fix. Scheduling regular check-ups and addressing issues as they arise can save you money in the long run. Understanding the importance of maintenance can help you keep your boat in top shape and ensure that it remains a valuable asset throughout your ownership.

“Beware of little expenses; a small leak will sink a great ship.” — Benjamin Franklin

Yacht vs. Standard Boat: Is One a Better Purchase?

Deciding between a yacht and a standard boat depends largely on your intended use and budget. Yachts often come with a higher purchase price but also offer luxurious amenities and greater space, making them ideal for long cruises or entertaining. On the other hand, standard boats are more affordable and can be easier to maintain. However, the cost of owning a yacht extends beyond the purchase price; maintenance, marina fees, and insurance are typically higher. In contrast, a standard boat might depreciate faster, but the overall ownership costs could be lower. When considering a purchase, it’s essential to balance these factors and determine which option aligns better with your lifestyle and financial situation.

Comparing Purchase Prices and Initial Costs

When deciding between a yacht and a standard boat, one of the first considerations is the purchase price. Yachts are typically more expensive than standard boats, not just in terms of the initial purchase but also in terms of insurance, maintenance, and storage. However, yachts often come with more luxurious features and amenities, making them more appealing for extended trips or entertaining. On the other hand, standard boats are more budget-friendly and easier to maintain, making them a practical choice for those who enjoy occasional outings. Comparing these costs is essential in deciding which type of boat fits your lifestyle and financial situation best.

Evaluating Long-Term Ownership Costs

Long-term ownership costs vary significantly between yachts and standard boats. Yachts often require more substantial maintenance, higher insurance premiums, and more expensive storage solutions. However, they also offer a level of luxury and comfort that standard boats cannot match. Conversely, standard boats, while more affordable initially, may depreciate faster and require replacement sooner. Evaluating these long-term costs helps you understand the true financial commitment of owning either type of boat. Careful consideration of these factors will guide you toward making a purchase that aligns with your financial goals and boating needs.

[lasso rel=”amazon-8″ id=”10133″]

Conclusion

Thinking about buying a boat? It’s exciting, but there’s more to it than just the thrill. Boats often depreciate fast, which means their value can drop pretty quickly. This makes boat ownership more than just a one-time buy. You’ve got to consider the maintenance and other costs that come along for the ride. But if you love spending time on the water, it might be worth every penny. After all, for some, the memories and fun make the investment pay off in ways money can’t measure.

On the flip side, not every boat is a great investment. Especially with older boats, you might find yourself dealing with expensive repairs that can turn your dream into a money drain. Whether you’re eyeing a new or used boat, it’s important to think this through. Make sure you’re ready for everything owning a boat really means.