Introduction

Personal finance is about managing your money wisely. It includes making plans for your spending, saving, and investing. If you are new to managing your money or want a fresh start, this guide is for you. We will explore important ideas that help you handle your finances better.

From setting budgets to making smart choices with your money, each part of this article shows you simple ways to get control. Understanding personal finance can feel difficult, but breaking it down into easy parts makes it easier for you to improve your money habits. Let’s begin your journey to smart money management for a better future.

The Importance of Budgeting

What is a Budget and Why You Need It

A budget is simply a plan for your money. It’s about deciding in advance how much to spend and how much to save. Instead of wondering where your cash disappeared each month, a budget gives you a clearer picture. Think of it as a way to guide your money rather than just react to bills and purchases. Without one, money can easily slip through your fingers without you noticing.

You might think budgeting sounds restrictive or complicated, but that’s not actually the case. It’s more like setting a few rules for your money so you feel more in control. When you know where your money needs to go, you reduce stress and can make smarter choices—like saving for a goal or avoiding debt. It’s the foundation of good personal finance because all smart money decisions build on it.

How to Make Your First Budget

Starting your first budget might feel a little intimidating, but breaking it into steps helps. Here’s a straightforward way to get going:

- Step 1: Write down your monthly income. Include your salary, side gigs, or anything regular you get. For example, if you earn $2,500 a month, that’s your baseline.

- Step 2: List your fixed expenses. These are bills you pay every month like rent, utilities, or subscription services. Let’s say rent is $800 and utilities average $150.

- Step 3: Estimate variable expenses. These are less predictable, such as groceries, gas, or entertainment. Maybe groceries cost around $300, gas $100, and fun money about $100.

- Step 4: Subtract expenses from income. See how much money remains or if you’re overspending. In this example, $2,500 – ($800 + $150 + $300 + $100 + $100) equals $950 left.

- Step 5: Adjust as needed. If you have money left, decide if you want to save or pay off debts. If you’re short, look for areas to cut back.

Don’t fret if your first budget isn’t perfect. It’s normal to tweak it a few times before it feels right. The key is to keep it simple and realistic. Remember, a budget isn’t about stopping all spending, but guiding it.

Tracking Your Income and Expenses

Knowing exactly where your money goes can feel a bit tedious at first, but it’s a step that often makes a big difference. When you track both the money coming in and going out, you start to see patterns — some expected, some surprising. It’s not just the big bills that matter. Those small, seemingly insignificant purchases, like that daily coffee or an occasional snack, add up more than you might think.

Why bother with every penny? Because those little expenses can quietly drain your finances without much notice. Maybe you spend a few dollars here and there, and it doesn’t seem like much. But put it all together over weeks or months — suddenly, it’s a noticeable chunk of your income that could be saved or redirected.

Tracking doesn’t need to be complicated or time-consuming. You can:

- Use apps that automatically categorize expenses for you, like Mint or YNAB, if you prefer a digital approach.

- Keep a simple notebook and jot down daily spending – sometimes writing it out helps make things clearer.

- Create a basic chart or spreadsheet, listing income sources and every expense, grouped by category.

Pick what feels manageable. And don’t worry about being perfect; even rough tracking brings insight. You might find yourself surprised by where your money really goes. That alone can spark changes in how you handle spending and saving. Have you ever tracked your expenses down to the last dollar? What did you learn?

Understanding Needs vs Wants

Defining Needs and Wants

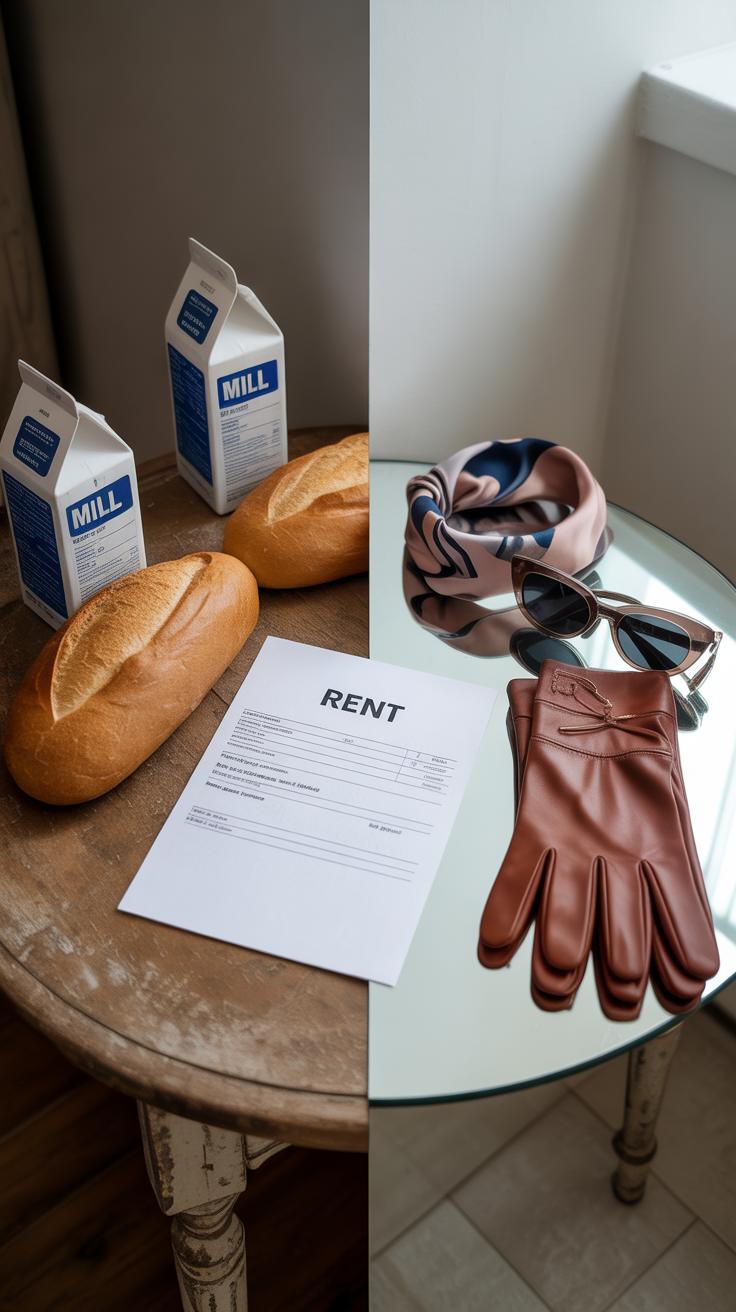

At first glance, it might seem simple to tell what’s a need and what’s a want, but it’s not always clear-cut. Needs are things without which you can’t function well—think food, shelter, basic clothing, and transportation to get to work or school. Wants, by contrast, are items or experiences that add comfort or pleasure but aren’t essential. For example, you need clothes to stay warm, but a designer jacket is more of a want. Similarly, you need a phone to communicate, yet the latest model with all the fancy features falls into the want category.

Sometimes, the line blurs. Is internet access a need or a want? For many people, working or learning from home depends on it, so it leans toward a need. But that expensive streaming subscription on top of it? Probably a want. The key is to think about what you must have to live and keep your life running smoothly, even if it’s a little uncomfortable.

Making Thoughtful Spending Decisions

Impulse buying messes with good money habits. That sudden urge to grab something because it’s “on sale” or just looks fun can throw off your budget. Ever noticed how walking down a store aisle or browsing online can tempt you into spending on things you didn’t plan? Yeah, me too. The trick is catching yourself before hitting “buy.”

Try this little test before any purchase: ask yourself if this item supports your basic needs or just satisfies a fleeting desire. Wait an hour, even a day, and see if you still want it. That pause can stop many impulse buys. Also, keeping a list of needs can be handy—it helps to stay focused during shopping.

You might find that some wants become needs over time, or vice versa. That’s okay and normal. The goal isn’t to be perfect but to keep your spending aligned mainly with needs first, which helps avoid unnecessary financial strain. What’s a want you recently thought was a need? Have you stopped to reconsider it since?

Saving Money for Emergencies and Goals

Saving money feels like a slow process, but it’s one of those habits that really pays off when life throws curveballs your way—or when you want to treat yourself to something special without guilt. Think about it: emergencies don’t announce themselves. Car repairs, sudden medical bills, job changes—these things can pop up without warning, shaking your budget if you’re not ready.

On the flip side, saving also helps you reach goals you actually plan for, like a trip you’ve been thinking about or that new laptop you need. Having money set aside for these things means you can enjoy them without scrambling or relying on credit. This balance—between being prepared and aiming for what matters—is a tricky one. But it’s worth figuring out.

Building an Emergency Fund

Starting an emergency fund doesn’t need to be overwhelming. Even small amounts add up over time—really, even $5 here and there can make a difference. The key is to choose a separate place for this money, like a savings account you don’t touch lightly. That way, it’s out of easy reach when temptation knocks.

Try to save something regularly, even if it’s irregular or unpredictable. For example:

- Put aside a few dollars every paycheck.

- Transfer unexpected income, like a tax refund or gift, into the fund.

- Cut back on small daily expenses, perhaps that extra coffee, and funnel that money in instead.

The goal isn’t perfection. It’s slow, consistent progress. Maybe focus on reaching $500 at first—you might be surprised how freeing that cushion feels.

Saving for What Matters to You

When it comes to saving for something you want, clarity is key. Ask yourself what really matters—what you’d genuinely feel good about spending on. Setting a clear goal gives you a real reason to save, not just an abstract idea.

Break your goal into chunks. If you want to buy a bike for $600 in six months, that’s $100 a month. Knowing this makes saving less vague and more doable.

Here’s a simple plan to try:

- Decide on your goal and deadline.

- Figure out how much you’ll need to save each week or month.

- Track your progress and celebrate small wins.

- Adjust if life gets in the way—sometimes goals shift, and that’s okay.

Saving isn’t always easy. Sometimes you feel motivated, other times less so. But having something clear to aim for makes it a bit more meaningful—and maybe even a little rewarding.

Getting to Know Credit and Debt

How Credit Works

Credit is basically borrowing money that you promise to pay back later. When you use a credit card or take out a loan, you’re getting access to funds now, but you’ll owe that money—and sometimes more—down the road. Credit cards let you buy things now and pay for them later, often within a month without interest if you pay in full. Loans, like personal or auto loans, give you a lump sum upfront which you repay through monthly payments over time.

Interest is the cost of borrowing. Think of it as a fee for using someone else’s money. It adds up on anything you don’t pay off quickly. Sometimes, this interest feels small at first but grows faster than you might expect. That’s where trouble usually starts.

Handling Debt Wisely

Debt isn’t bad by itself, but it can get tangled quickly. It’s easy to fall into debt traps—like only paying the minimum on credit cards or borrowing more just to cover old debts. Those traps can make what you owe balloon without much progress.

To stay on track:

- Know exactly what you owe and to whom. Write it down and keep track.

- Pay more than the minimum when you can; it burns down the balance faster and saves money on interest.

- Avoid borrowing for things that don’t hold value or don’t improve your situation.

- If debt feels overwhelming, don’t ignore it. Reach out for help early—whether that’s a financial counselor or support programs.

Managing credit and debt carefully can keep you from stress and start rebuilding your financial freedom. It’s tricky, but you begin by knowing what you’re really dealing with. Ever noticed how easy it is to forget small charges pile up? Keeping tabs helps you avoid surprises.

Basics of Investing

What is Investing and Why Try It

Investing means putting your money into something with the hope it will grow over time. It’s different from saving, which usually means holding onto your money in a safe place where it’s easily accessible but doesn’t really increase much. When you save, your money stays mostly the same, maybe earning a tiny bit of interest. Investing, on the other hand, carries some risk but has the potential to build your wealth more noticeably.

You might wonder why bother with the risk? Well, saving alone rarely beats inflation — meaning your money might lose value just by sitting still. Investing can help your money keep up with or even outpace inflation. Of course, it’s not a guaranteed win every time, and the ups and downs can feel uncomfortable if you’re new to this.

Simple Investment Options for Beginners

If you’re just starting and want to keep things simple, here are a few options that most beginners find approachable:

- Savings Accounts: These offer small interest and carry almost no risk. Your money stays accessible and safe, good for short-term goals.

- Bonds: When you buy bonds, you’re essentially lending money to a company or government. They pay back with interest over time. Bonds tend to be more stable than stocks but with lower returns.

- Basic Stocks: Buying stocks means owning a piece of a company. Stocks can grow more than bonds or savings, but the value can jump up and down. Aiming for well-known companies or low-cost index funds can lower some risks.

Starting with these may feel slow or cautious, but that’s okay. Investing doesn’t have to be complicated to be helpful. What feels most important is picking something you understand well enough to stick with. Ever tried watching your stocks fluctuate and panicked a bit? You’re not alone. Taking small, manageable steps is often the best way to build confidence and grow your money over time.

Understanding Insurance and Protection

Insurance can feel like a dull topic, but it’s actually one of those things that quietly saves your financial skin when life throws a curveball. At its core, insurance is a way to share risk. You pay a fee—called a premium—to an insurance company, and in return, they help cover certain costs if something unexpected happens. That “something” could be an illness, an accident, or damage to your home. Without insurance, these events can wipe out your savings or even leave you in debt. It’s a form of protection, not just for your money, but for your peace of mind too.

Types of Insurance You Should Know

Not all insurance is the same. Here are some common types, explained simply:

- Health Insurance: Helps pay for doctors, hospital visits, and medicines when you’re sick or hurt.

- Life Insurance: Provides money to your family if you pass away unexpectedly. It’s about financial support when you’re gone.

- Property Insurance: Covers damage or loss of your house, apartment, or even your car from fire, theft, or accidents.

- Disability Insurance: Pays you income if you can’t work due to injury or illness.

Each one has a slightly different goal, but they all protect your finances from problems you can’t predict or control.

How Insurance Fits into Your Financial Plan

Deciding what insurance you need isn’t simple. You want enough coverage to avoid big financial setbacks but not so much that insurance costs control your budget. Think about your situation:

- Do you have dependents who rely on your income?

- Could medical bills break your finances?

- Do you own a home or car that’s valuable to protect?

Answering these questions helps you pick what fits you. If you’re young and healthy, maybe life insurance feels less urgent, but health insurance probably isn’t optional. It can feel like a balancing act, and honestly, your needs might change over time. Revisiting your insurance regularly is a good idea—trust me, I’ve learned that the hard way.

Planning for Retirement Early

What is Retirement Planning

Retirement planning means thinking ahead about how you’ll support yourself when you stop working. It’s about setting aside money now to cover your needs later on. You might think retirement is still a long way off, but it’s more than just a distant idea—it’s a part of your financial future that can’t be ignored.

You might wonder, “Why start so early if retirement feels far away?” Well, the earlier you begin saving, the more time your money has to grow. That growth can come from interest, investments, or compounding returns. Though it sounds a bit abstract, this actually makes a big difference over decades.

Easy Steps to Start Saving for Retirement

Even if your current budget feels tight, there are simple ways to start saving for retirement that don’t require a big upfront amount. Here are some straightforward ideas:

- Open a retirement account like an IRA or a 401(k) if your employer offers one. Contribute what you can—even a small amount adds up.

- Set aside a fixed small amount each payday. Automate it so you don’t have to think about it every month.

- Look for employer matches on 401(k) contributions—that’s free money. It’s surprising how often people miss out on this.

- Consider low-cost index funds or target-date funds that adjust risk based on your age. These require less active management.

- If you’re self-employed or don’t have access to workplace plans, start a Simple IRA or Solo 401(k). They’re designed for solo workers but come with certain limits.

Starting early means even modest contributions can grow substantially over time. It might feel slow or even frustrating at first. But remember, saving a little today can mean financial comfort decades from now. If you wait until later, you may have to save more aggressively—or settle for less security.

Have you thought about what retirement might look like for you? Sometimes just imagining the future helps make saving feel less abstract and more urgent. Don’t let uncertainty stop you from taking small steps now—it’s worth it, even if you’re unsure about everything else.

Paying Taxes and Keeping Records

Basics of How Taxes Work

Taxes are part of life, whether we like it or not. At their core, income taxes mean you pay a percentage of what you earn to the government. It might seem straightforward, but taxes can feel confusing, especially when you start seeing terms like withholding, deductions, and credits. These influence how much you eventually owe or get back. You might wonder—should I care if my employer withholds too much or too little? The truth is, getting a handle on this can actually save you money or prevent a surprise bill later.

Everyone should know how tax brackets work, even just a little. The more you earn, the higher percentage of your income you generally pay. But, deductions and credits can lower that bite. It’s not always clear cut, and the rules change every year. So, staying curious and checking in on your taxes now and then helps avoid trouble or missed opportunities.

Organizing Your Financial Records

Keeping your financial papers in order feels like a chore, but it often pays off. Staying organized means you’ll find documents fast when filing taxes or sorting out bills. Plus, having a neat system cuts down stress later—especially around tax season. I’ve noticed that if I’m sloppy with receipts or statements, things pile up quickly, and then the task seems worse than it actually is.

Here’s a few simple ways you might start:

- Create folders—digital or physical—for bills, receipts, bank statements.

- Set a weekly or monthly reminder to tidy and file new documents.

- Scan important papers to avoid paper clutter and keep backup copies.

- Mark important deadlines like tax day or bill due dates on a calendar.

When you keep track, you catch errors sooner and avoid penalties or lost refunds. It might feel like overkill at first, but once you see how much easier tax time gets, you might just stick with it.

Building Good Money Habits That Last

Creating routines around managing your money can feel like a challenge, especially at first. Maybe you’ve tried keeping a budget or saving but got discouraged. It’s normal to slip up or lose focus sometimes. What really matters is forming habits that stick through the ups and downs.

Simple daily or weekly actions can make a big difference if you keep at them. For example:

- Review your budget regularly—don’t just set it once and forget. Check how you’re tracking against your goals at least weekly.

- Put aside a fixed amount for saving, even if it feels small. Over time, that adds up.

- Resist impulse buys by pausing before spending on non-essentials. A little hesitation can prevent unnecessary debt.

Staying motivated isn’t always easy. Sometimes, progress feels slow or invisible. But remember why you started—whether it’s peace of mind or a future plan. Try breaking big goals into tiny steps so you see wins more often. And don’t hesitate to adjust your routines if they don’t quite fit your life.

Ask yourself: what habits have helped you before, even in unrelated areas? Could you apply those same tricks to money? Often, it’s less about radical change and more about making small, consistent choices that build over time.

Conclusions

Taking charge of your personal finance starts with small steps. By practicing budgeting, saving, and planning, you grow more confident managing your money. Remember, every choice you make about spending and saving shapes your financial future.

Keep learning and asking questions about your money. Making good decisions helps you reach your goals faster. Use what you’ve learned to stay on track and enjoy a sense of control over your financial life. The future is yours to build with smart money habits.